It’s time for a new way to think about investing, one that can contend with the complex risks we face today. Previously, investors could find ways to insulate their portfolios from certain global events. Today, even seemingly ‘local’ events can immediately and adversely affect all portfolios. The largest, most influential investors are recognizing this trend and considering the interconnection between environmental and societal systems under stress and adverse portfolio performance.

Those same investors are adapting and adopting policies and practices that are additive to conventional investment scrutiny at the security and portfolio levels, helping them to confront global environmental and social systemic challenges in a way that makes financial sense. Adjusting to a changing world of risks, these asset owners and asset managers are charting the next, critical shift in the evolution of investment, what we call system-level investing.

The 3rd Annual System-level Investing Symposium is co-hosted by TIIP, The U.S. Impact Investing Alliance, and Principles for Responsible Investment and made possible with support from Domini Impact Investments, Orrick and the High Meadows Institute.

The event will take place on April 10th in New York City and is an opportunity to join together with key investors and influencers to help establish and refine a shared vision of system-level investing and stewardship; identify system-level investing examples; discuss opportunities, challenges, and breakthroughs needed; and to help the industry avoid working at cross-purposes.

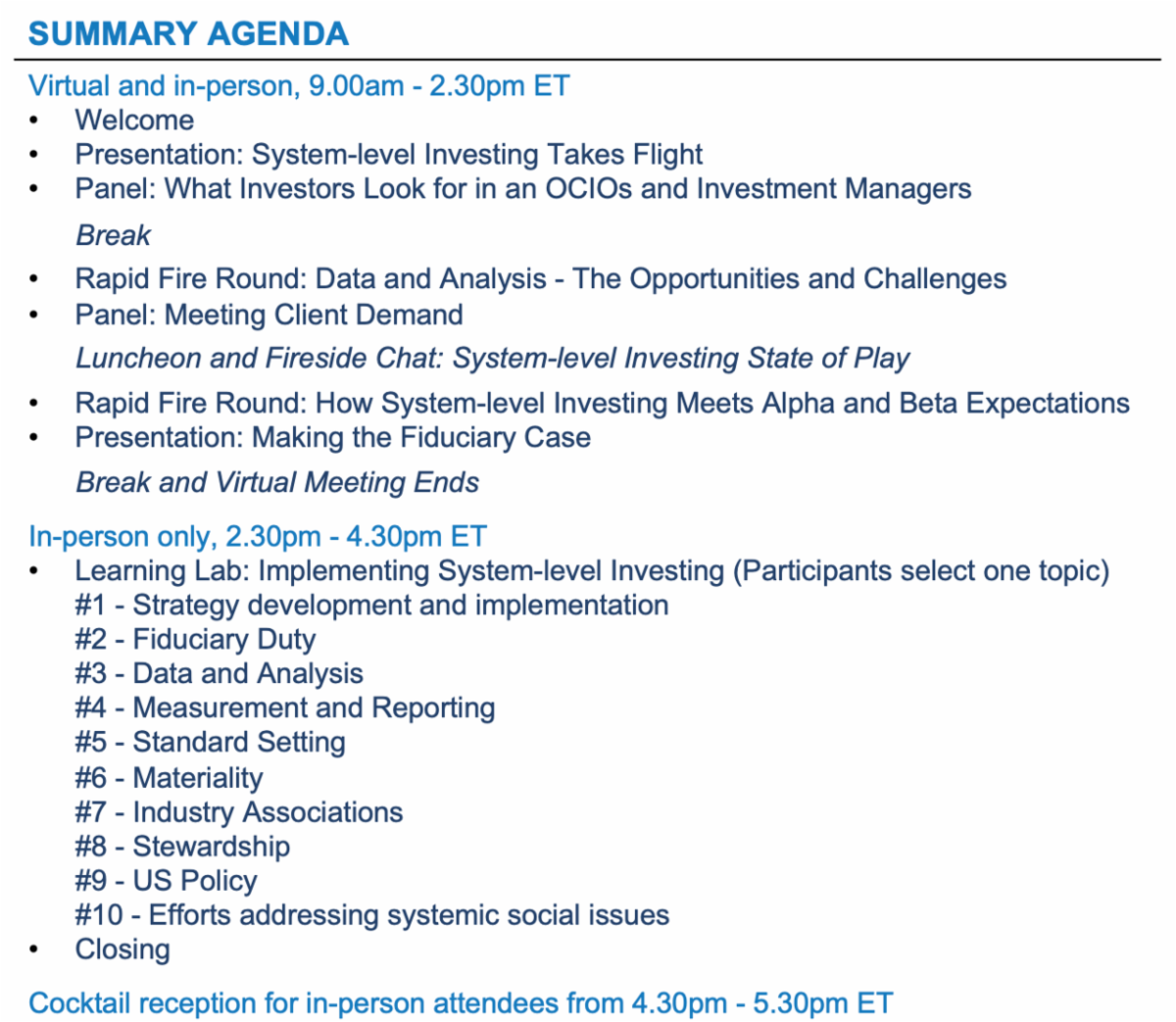

This hybrid event, with participants able to join either in-person or online, will include remarks from TIIP as well as feature other leaders at the forefront of the system-level investing movement.

During the first part of the day, participants will hear from investors who are harnessing system-level investing to address the societal, financial, and environmental systemic risks of today. In the afternoon, in-person attendees will be able to share their views with peers in a “Learning Lab” focused on pivotal topics in system-level investing, including fiduciary duty, materiality, shareholder engagement, standard setting and more.

Key research will also be released during the event, including a series of case studies on the first-mover investment teams that have acknowledged the importance of—and embraced the practices for—system-level investing. These investors, many of whom will be speaking at the event, are demonstrating where the field is headed and presenting a path forward for other investors to learn from their peers and to join them on the vanguard of this evolution.

**Space is limited for the in-person gathering. All interested in attending who cannot be accommodated in-person will be able to participate virtually.**

Registration for this event is available here.

Interested in becoming a sponsor of the event? Reach out to Monique Aiken, the Managing Director of TIIP, at [email protected]

Follow us on LinkedIn to keep up with the latest TIIP news and find out how to join the system-level investing movement. Reach out to us at [email protected] with any questions or to learn how to become a SAIL subscriber today.

Manage Systemic Risks and Opportunities

Established in 2015, The Investment Integration Project’s (TIIP) mission is to help investors understand how healthy social, environmental, and financial systems can benefit their portfolios. TIIP provides consulting services, applied research, and a subscription-based SaaS platform that supports investors’ pursuit of system-level investing, an advanced approach to sustainable and impact investing that focuses on managing systemic risks and investing in solutions to systemic problems.

Learn more at http://www.tiiproject.com