Chief Investment Officer Magazine: Multi-part Series

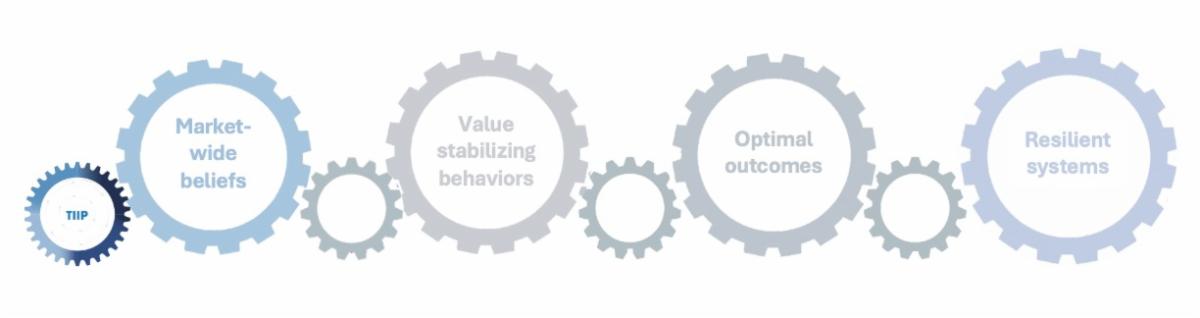

This multi-part op-ed series authored by TIIP’s CEO, William Burckart, explores the urgent need for institutional investors to re-examine core assumptions about investing—especially in a world increasingly shaped by systemic threats.

Part I: Outdated Financial Theory Is Failing Us All: What CIOs Must Rethink About Risk, Return and Resilience

- The first installment in the series challenges the limitations of Modern Portfolio Theory, traditional ESG integration, and even impact investing as they’ve commonly been practiced. It (re)introduces the concept of system-level investing as a next-generation approach designed to link portfolio performance with the health of the systems that sustain long-term value—climate stability, financial market integrity, inclusive economies, and more.

Click here to read Part 1.

Part II: What System-Level Investing Is—and Why It’s Different From Any Approach You’ve Used Before

- This second installment takes a closer look at the definition—and distinctiveness—of system-level investing. It clarifies how this approach is rooted in fiduciary duty, spans the entire portfolio (and beyond), and aims to strengthen the underlying systems that long-term returns depend on. Importantly, it also distinguishes system-level investing from adjacent frameworks like “systemic investing,” “investing for systems change,” and “financial ecosystems for transformation.” While many of these models are deeply transformative, they are often grounded in different forms of accountability—community outcomes, moral alignment, or intergenerational justice—rather than fiduciary duty. As a result, they may prioritize narrative change, movement building, or trust-based partnerships over traditional investment tools.

- Yet these distinctions do not imply opposition. Quite the opposite. Clarity here isn’t just a matter of semantics—it’s essential for institutional investors aiming to act decisively and credibly in a time of compounding systemic risk.

Read Part II here.

Part III: System-Level Investing in Practice—From Beliefs to Blueprints

- The final installment in the series explores how institutional investors are operationalizing system-level investing—from revising investment beliefs to deploying new tools and practices. Drawing on examples from CalSTRS, PGGM, University of Cambridge, and others, this piece highlights how forward-looking investors are realigning strategy, investment approaches, stewardship, and policy engagement to safeguard the systems their portfolios rely on.

- It also introduces the Systems Aware Investing Launchpad (SAIL), TIIP’s AI-enhanced platform that enables investors to act on system-level insights at scale. The takeaway is clear: system-level investing isn’t just theory—it’s fast becoming the new standard for institutional leadership.

Part III can be found here.

4th Annual Symposium Featured Video Highlight: CalSTRS

TIIP’s 4th Annual Symposium and 10-Year Anniversary: Insights, Innovation, and Inspiration.

TIIP’s 4th Annual Symposium on System-Level Investing—marking our 10-year anniversary—was a milestone gathering, filled with sharp insights, bold ideas, and powerful calls to action. We were also proud to debut the inaugural System-Level Investing Awards, honoring exceptional leaders who are helping to define and advance this essential field.

Our speakers shared timely, practical, and visionary perspectives across sessions—and we’ll continue spotlighting those learnings in the months ahead.

Watch Now: “Leveraging Scale for System-Level Progress”

This month’s featured video is the opening panel discussion, “Leveraging Scale for System-Level Progress,” featuring senior members of the California State Teachers’ Retirement System (CalSTRS) team. (Full disclosure: CalSTRS is a SAIL platform subscriber.) The conversation was expertly moderated by Cambria Allen-Ratzlaff, Chief Responsible Investment Ecosystems Officer at the UN Principles for Responsible Investment (PRI).

The panel explored how CalSTRS uses its scale and strategic influence to advance system-level outcomes—supporting long-term sustainability, improved market transparency, and stronger governance practices.

Panelists:

- Sharon Hendricks – Vice Chair of the Board of Trustees CalSTRS

- Aeisha Mastagni – Senior Portfolio Manager, Sustainable Investment & Stewardship Strategies, CalSTRS

- Lynn Paquin – Portfolio Manager, Sustainable Investment & Stewardship Strategies, CalSTRS

Special Rate for the first 30 SAIL 2.0 Subscribers!

✨ Get Early Access to SAIL 2.0: The Systems Aware Investing Launchpad

Be among the first to subscribe to SAIL 2.0—TIIP’s next-generation, AI-enhanced platform built to help institutional investors operationalize system-level investing. Whether you’re an asset owner, investment consultant, or asset manager, SAIL offers the infrastructure you need to act on the systemic risks and opportunities shaping long-term portfolio performance.

Why SAIL?

System-level risks—like climate instability, inequality, and market short-termism—are no longer hypothetical. They are material. Yet too many investors lack practical tools to integrate systems thinking into daily decision-making.

SAIL 2.0 changes that.

What Sets SAIL Apart?

AI-enhanced, human-led, and field-tested.

Built on a decade of research and real-world use by more than 150 institutional investors, SAIL offers:

✅ Strategic tools that don’t require starting from scratch

⏱️ Benchmarking that doesn’t take weeks

📊 Reporting that adds value—not workload

🤝 A peer community tackling system-level challenges together

⚡ The Result?

No more choosing between complexity and clarity. SAIL brings it all together—because system-level investing deserves an integrated platform.

Ready to Set SAIL?

Join the movement from reactive reporting to proactive regeneration.

The first 30 subscribers to SAIL 2.0 will receive a promotional launch rate—act now to secure your early access.

👉 Schedule a demo or subscribe today by emailing us at [email protected]

What We’re Reading

July 7, 2025 – Pension capital should support pension holders’ interests and drive economic growth by Impact Investing Institute

Key takeaways:

- The Impact Investing Institute argues that current UK pension laws are preventing funds from investing the country’s £2.5 trillion in pension capital in areas like clean energy, housing, and small businesses that could benefit both savers and the broader economy due to unclear fiduciary duty regulations

- Two key legal changes are on the horizon for the upcoming Pension Schemes Bill:

- Clarifying that Trustees can consider economy-wide risks like climate change, and

- Explicitly permitting Trustees to assess how investments affect the UK economy and living standards.

- Confirmation of these changes would unlock pension capital to support economic growth while still delivering competitive returns for beneficiaries.

TIIP’s take:

- Clarifying fiduciary duty is not a technical tweak—it’s a foundational shift. The proposed legal changes in the UK represent a critical step toward enabling pension funds to take the long-term, system-aware actions their beneficiaries—and the broader economy—need. TIIP believes that system-level investing is not only compatible with fiduciary duty, it’s increasingly required by it.

The full post can be found here.

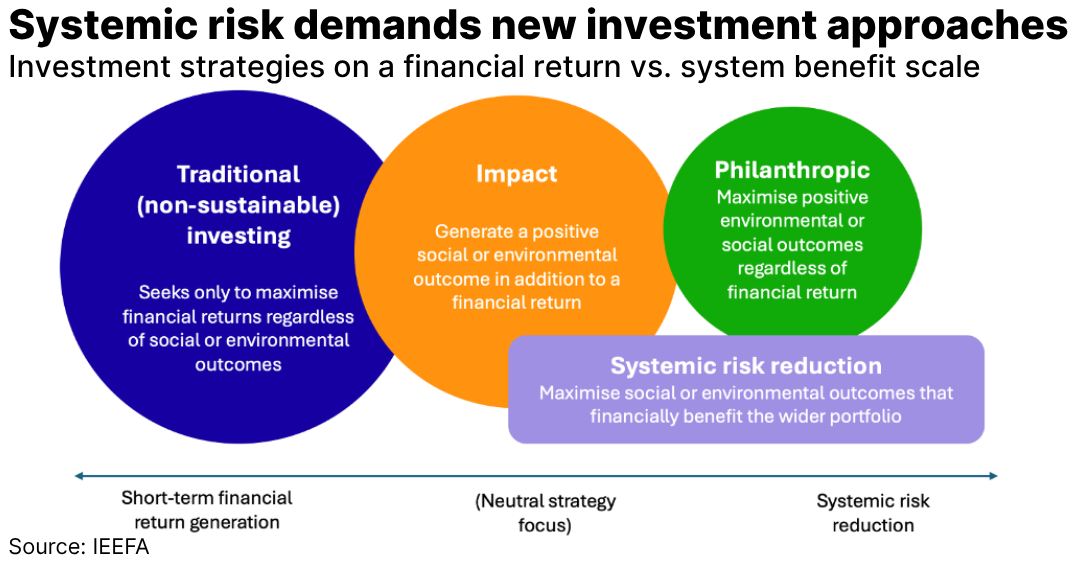

June 16, 2025, Systemic risk reduction funds: Why impact investing needs to get selfish by Alasdair Docherty @ Institute For Energy Economics and Financial Analysis

June 16, 2025, Systemic risk reduction funds: Why impact investing needs to get selfish by Alasdair Docherty @ Institute For Energy Economics and Financial Analysis

Key takeaways according to the author:

- Asset owners are increasingly concerned by systemic risk, which modern portfolio theory remains fundamentally ill-equipped to address.

- IEEFA proposes the establishment of “systemic risk reduction” funds, designed to support the long-term health of investors’ wider portfolios instead of short-term returns at the fund level.

- Legal discourse of fiduciary duty is already evolving. The door has opened for funds targeting systemic risk reduction to proliferate as part of broader investor strategies.

- Systemic risk reduction funds represent a potentially significant growth market and business opportunity for asset managers while also providing a stepping stone to system-level investing.

TIIP’s take:

- We strongly support IEEFA’s call for “systemic risk reduction funds.” That’s precisely the rationale behind TIIP’s Systems Aware Investing Launchpad. As fiduciaries face mounting systemic threats, the tools and strategies to reduce those risks must evolve accordingly. These funds are a promising pathway to align portfolio resilience with real-world impact.

Read the full paper here.

June 16, 2025 – Easier Said Than Done: Shifting Private Foundation Assets to Offset Proposed Tax Could Prove Difficult by James Van Bramer @ Chief Investment Officer

June 16, 2025 – Easier Said Than Done: Shifting Private Foundation Assets to Offset Proposed Tax Could Prove Difficult by James Van Bramer @ Chief Investment Officer

Key takeaways:

- Graduated Tax Structure Creates Significant Financial Impact: The proposed tax would dramatically increase rates for larger foundations – from the current 1.39% to as high as 10% for foundations with over $5 billion in assets. This tiered system would generate an estimated $15.88 billion in federal revenue over 10 years.

- Asset Allocation Dilemma Between Liquidity and Tax Avoidance: Foundations face a challenging balance because they must maintain liquidity to meet the legal requirement of distributing 5% of assets annually as grants, while potentially needing to shift toward illiquid investments like private equity to minimize tax exposure on capital gains.

- Risk of Reduced Charitable Giving: The greatest concern is that foundations may reduce their grant-making to offset higher tax burdens. This creates a fundamental tension between tax optimization and fulfilling their charitable mission, potentially harming the social sector during critical times.

- Limited Strategic Options with Long-Term Consequences: Foundations must choose between accepting lower after-tax returns with current portfolios, increasing investment risk to maintain returns, or reducing charitable distributions. Each option carries significant long-term implications for both the foundation’s sustainability and its impact.

- Legislative Uncertainty Complicates Planning: The tax provision’s inclusion in different versions of congressional bills creates uncertainty that makes strategic planning difficult for foundation leaders, who must wait for the final legislative outcome before making major portfolio adjustments.

Bill Burkart’s quote from the article:

“In this unpredictable environment, foundations are grappling with tough trade-offs,” says Bill Burckart, CEO of the Investment Integration Project, where he advises private foundations. “Is the answer cutting staff? Scaling back program requirements? Or is it increasing exposure to riskier investments to preserve grantmaking levels? None of these decisions are easy, and they all carry long-term implications.”

Full article here.

June 10, 2025 – The Long Term Will Be Decided Now: Why Climate Risk Demands System-Level Action from Investors by Ben Cushing @ Sierra

June 10, 2025 – The Long Term Will Be Decided Now: Why Climate Risk Demands System-Level Action from Investors by Ben Cushing @ Sierra

Key quote (emphasis added by TIIP):

“To reduce real-world emissions and systemic risk, investors must adopt a system-level approach that strategically redirects financial flows, shifts corporate behavior, and shapes public policy. This requires effective use of four key levers: capital allocation, investment stewardship, policy advocacy, and service-provider accountability. Tailoring strategies to the structure of financial markets—especially differences between debt and equity, and between primary and secondary markets—is essential to targeting actions where investor influence is most direct and powerful. System-level investing ensures that financial tools are applied across asset types and decision points to maximize real-economy impact.”

TIIP’s take:

- It’s encouraging to see system-level investing applied so clearly to the challenge of climate risk. Ben Cushing and the Sierra team make a compelling case for coordinated action across capital allocation, stewardship, policy, and accountability. This is the kind of integrated strategy we need to confront systemic threats head-on—and we’re honored to see TIIP’s work cited in the piece.

Read the paper here.

May 1, 2025 – Investor Fiduciary Duties in the Crosshairs – Targeting a Mirage by Keith Johnson, Susan N. Gary and Nicholas Zuiker @ Social Sciences Research Network (SSRN)

Abstract:

The fiduciary duties of institutional investors have become a hot issue amongst policymakers and courts, with the future financial security of millions of American workers and savers at stake. Unfortunately, many recent policy debates and court opinions on investor fiduciary duties demonstrate only a limited understanding of fiduciary duty principles. A more complete appreciation of the full range of investor fiduciary duties is essential to inform policy and court decisions that affect the future financial security and economic stability of America. This article offers a guide to essential investment fiduciary concepts that have been missing from recent policy debates and court decisions.

Excerpt from the conclusion:

“Decisions by policy makers and courts should be made with a full understanding of the facts and legal principles being debated. Unfortunately, many of the ongoing culture war debates involving investor fiduciary duties are being fought with a limited understanding of what is being considered. Legal principles that have often been ignored include the:

- intergenerational duty of impartiality between participant groups with conflicts of interest,

- forward-looking process framework required for investor fiduciary decisions,

- obligation to investigate “relevant” facts and

- dynamic nature of the prudent standard of care.

In addition, there has been almost no recognition of lessons learned during the last

half of the 20th century about the dangers of denying investor fiduciaries the flexibility to adapt to evolution of markets, knowledge and real-world circumstances.”

TIIP’s take:

- Kudos to Keith Johnson and co-authors for this essential contribution. Misinterpretations of fiduciary duty have too often justified investor inaction—or even harmful action—on systemic risks. This paper lays out the legal grounding for a forward-looking, adaptive fiduciary framework that aligns with system-level investing. Required reading for anyone shaping—or scrutinizing—investment policy today.

Full text here.

Consulting with TIIP: From Concept to Implementation

In 2015, TIIP’s Steve Lydenberg and William Burckart coined the term system-level investing—a breakthrough approach to aligning investment practices with the long-term health of environmental, social, and financial systems.

Since then, TIIP has been at the forefront of this work, publishing field-defining research and advising many of the world’s leading institutional investors.

Why System-Level Investing?

System-level investing goes beyond ESG and impact investing. It confronts root causes of systemic risk—from climate instability to inequality—and equips investors with tools to shape more resilient systems.

This approach is now recognized globally. It underpins Pathway B of the UN PRI’s strategic framework, setting it apart from traditional ESG integration (Pathway A) and impact investing with limited systemic focus (Pathway C). (Source: UNPRI.org, “What is system-level investing?”, October 3, 2024.)

How TIIP Can Help

We provide tailored consulting across three core service areas to support institutional investors at any stage of their system-level journey:

1. Total Portfolio Activation: Lay the foundation. Build internal alignment.

- Readiness Assessments to diagnose challenges and chart a path forward.

- Board & Leadership Training customized for investment committees, trustees, and senior staff.

- Governance Support to establish oversight structures and embed accountability.

2. Total Portfolio Implementation: Operationalize strategy across the portfolio.

- SAIL Platform Access: Our subscription-based platform (SAIL) offers step-by-step guidance drawn from 21st Century Investing, the book that launched the discipline.

- Investment Policy Integration: Support embedding system-level principles into RFPs, investment beliefs, asset allocation, manager selection, engagement strategies, and more.

- Custom Engagements designed for asset owners, consultants, and mission-driven investors.

3. Total Portfolio Review: Measure progress. Identify opportunities. Stay ahead.

- Portfolio Diagnostics using TIIP’s system-level investing measurement framework.

- Manager Reviews to assess alignment with system-level principles.

- Benchmarking & Visibility through TIIP’s proprietary Benchmark Database (optional).

Ready to take your investment strategy to the system level? Let’s build solutions for long-term value and systemic resilience—together. Contact us today!

TIIP + Friends Around Town

Where We’ve Been

June 24: At this year’s Impact & Sustainable Finance Faculty Consortium in Chicago, TIIP’s Bill Burckart was joined by Randy Strickland, Jake Barnett and Donna Loveridge in a conversation entitled “System-level Investing”.

June 2: TIIP Advisory Council Member, Jon Lukomnik, gave the Opening Keynote at IEN’s 2025 Virtual Forum “Systemic Risks & System-Level Investing”.

May 15: Monique moderated a conversation with Andre Perry, Senior Fellow and Director, Center for Community Uplift, Brookings Institution and Samantha Tweedy, CEO, Black Economic Alliance at a session during the Total Impact Summit 2025 entitled, “Tying Our Roots Together: A Radical Conversation on Shared Humanity”

May 1: Bill was featured in the May issue of GOMAG in the article, “27 LGBTQ+ Leaders at the Helm”

April 10: In their final session before student teams presented their term-long projects, Bill Burckart, Jon Lukomnik, and their TA Tarunya Reddy, led a powerful “lessons learned” discussion with investors advancing system-level investing at scale. Panelists included: Takeshi Kimura of Nippon Life Insurance Company, Lynn Paquin of CalSTRS, Anna Snider of Bank of America, Amar N. of Koppa – The LGBTI+ Economic Power Lab. They were joined by a number of alumni of the course Daniel Sheehan, Wangeci Wanyahoro, Erik Stein, and Noveena Padala.

April 5: TIIP’s 4th Annual Symposium on System-level Investing, “From Vision to Action Using a Total Portfolio Approach” featured the following leaders:

April 3: The class zoomed out to look at the global landscape: System-level investing is gaining momentum—and attracting scrutiny. With more than 130 jurisdictions enacting sustainability and ESG-related laws (and U.S. states both supporting and opposing them), the regulatory environment is dynamic and often contentious they covered the latest in standard-setting and adoption (ISSB, EU, PRI, CFA Institute, UK stewardship definitions, and more), the evolving role of policy, regulation, and enforcement and how institutional investors are beginning to integrate system-level thinking into their investing approaches. Corey Klemmer, CFA, Esq, former SEC Policy Director and Director of Engagement at Domini Impact Investment grounded the conversation in the realities of policy, regulation, and practice.

March 27: For Session 8 of the graduate course on system-level investing at Columbia University, the team dove into fiduciary duty and materiality with Keith Johnson, CEO of Global Investor Collaboration Services, and Co-editor of the Cambridge University Handbook of Institutional Investment and Fiduciary Duty, to answer key questions like: What is material? To whom? And why? What is the difference between single vs. double materiality? Enterprise vs. Portfolio value? And, to explore the concept of dynamic materiality.

March 18: The Shareholder Commons (TSC) published its third annual edition of Portfolios on the Ballot (POTB), a proxy voting guide for investors who practice system stewardship to protect the value of their entire portfolios. It will flag numerous shareholder initiatives designed to protect the social and environmental systems that support all the companies in a diversified portfolio. For more details, watch the webinar and download the report click here.

March 13: One of the most pressing challenges (and opportunities) in system-level investing is progress assessment. Most investors rely on data, but system-level investors face a unique obstacle: current disclosure regimes focus on how external factors affect individual companies, not how companies impact essential systems. System-level effects—whether positive or negative—are often classified as externalities and either go unmeasured, are inconsistently tracked, or lack standardized assurance. So how can system-level investors evaluate their progress? To answer the question, the class on system-level investing was joined by Melissa Eng and Lazaro Tiant.

March 7: Bill joined Just Investing Podcast hosts Adam Sank and Matthew Illian to explore how investors can drive systemic change and address global challenges on the for the episode entitled, “The Future of Systems-Level Investing”.

March 6: Alongside guest speakers Kilian Moote, Tanya Khotin, Steve Lydenberg, TIIPs Founder & strategic advisor to Domini Impact Investments and Mary Beth Gallagher the class explored how investors can develop and implement an effective system-level investing strategy—one that mitigates key system-level risks while generating meaningful system-level rewards.we unpacked field-building techniques, which promote collective action to scale impact.

February 25: Renaye Manley – TIIP Advisory Council Member, board chair of The Horizon Project, and Finance and Pension Funds Fellow at the Center for Labor & a Just Economy – moderated a webinar entitled “State Pension Power: How State Policymakers Can Grow a Strong Economy for Retirees, Workers, and the Public.” Panelists included American Federation of Teachers President Randi Weingarten, Maryland Comptroller Brooke Lierman, and Minnesota Attorney General Keith Ellison.

February 13: Guest speakers, Cambria Allen Ratzlaff (Chief Responsible Investment Ecosystems Officer, Principles for Responsible Investment) and Beth Young (Consultant, CGSS-Corporate Governance and Sustainable Strategies LLC) joined William Burckart and Jon Lukomnik for their graduate course on system-level investing at Columbia University.

February 6: With guest speaker Rodney Foxworth, Bill and Jon’s graduate class on system-level investing at Columbia University examined how a fragmented system, leads to inefficiencies and challenges in capital markets. The session wrapped with a case study of the 2008-2009 Global Financial Crisis, shedding light on how the system’s gaps created profound ripple effects.

January 30: In this semester’s 2nd session of Bill and Jon’s graduate course on system-level investing at Columbia University, Adam Connaker, Director of Impact Investing at the Surdna Foundation, shared how Surdna aligns its century-long mission with policies that address systemic environmental and social challenges, Adam detailed how Surdna—via core programs on Inclusive Economies, Sustainable Environments, and Thriving Cultures—integrates impact-driven policies with financial prudence, breaks down systemic barriers, and builds strategic partnerships for a more equitable and sustainable future.

Where We’re Heading

September 21: Join Monique and the team at Make Justice Normal for the 2nd year of their street arts and climate action festival in Jackson Heights during NY Climate Week! The event is kid-friendly and everyone is welcome. Register here.

October 9-10: Join William at the Global LGBTIQ+ Inclusive Finance Forum, hosted by Koppa-The LGBTI+ Economic Empowerment Lab. Register here.

Follow us on LinkedIn to keep up with the latest TIIP news and find out how to join the system-level investing movement. Have questions about system-level investing? Email us at [email protected].