Reflections on 2025

At TIIP’s 4th Annual Symposium this April, co-hosted by the U.S. Impact Investing Alliance and the Principles for Responsible Investment (PRI), marking our 10-year anniversary, we returned to a point that has only grown more salient: investment decisions don’t simply respond to systems—they shape them.

That premise guided our work throughout 2025. Despite a difficult macro and political environment, investor attention continued to shift toward risks and opportunities that cannot be managed at the security or asset-class level alone. Climate instability, inequality, and financial system fragility increasingly show up as portfolio-level drivers of performance.

This year, TIIP partnered with institutions including Railpen, the Rockefeller Brothers Fund, High Meadows Institute, Tipping Point Fund on Impact Investing, and the Surdna Foundation to produce research and guidance that moves system-level investing from framing to execution. Across these projects, the through-line was consistent: investors are being called to understand their exposure to—and influence on—the systems that underpin long-term returns, and to embed that understanding into governance, investment strategies, and stewardship.

We also advanced SAIL 2.0, our AI-enhanced platform built to operationalize system-level investing at scale. Work that once took months—policy analysis, strategic alignment, benchmarking, diligence, and disclosure—can now be completed in hours. New diagnostic tools allow investors to identify gaps, prioritize actions, and reuse existing content across reporting regimes, materially reducing friction while improving decision quality.

These developments reflect a broader shift in the field. Managing systemic risks and rewards is no longer a question of ambition or values; it is increasingly recognized as a matter of fiduciary duty. The “groundwater” of financial performance—healthy markets, functioning institutions, resilient social and environmental systems—demands intentional investment and stewardship.

Looking to 2026, the challenge is less about direction and more about depth. The opportunity ahead lies in moving from isolated initiatives to durable, repeatable practice—integrated across portfolios and investment processes.

We look forward to continuing that work with investors who recognize that long-term value creation depends on the health of the systems we all share.

Railpen’s new report, Systemic Stewardship: The Financially Material Imperative – Embedding Systems Thinking and Stewardship into Practice, was developed in partnership with TIIP and Sinclair Capital.

Systemic stewardship is no longer peripheral—it is becoming central to how universal owners protect long-term value and manage financially material risks.

This work distills almost a year of collaboration with Railpen, examining how asset owners can understand and manage their influence on the systems that underpin their portfolios—and how stewardship, policy engagement, and investment strategy can be mobilized to reinforce those foundations. It reflects Railpen’s long-standing commitment to following the evidence on financial materiality, and we were honored to support them in this effort.

What this means for asset owners, OCIOs, asset managers, and advisors

- Systemic risks—climate instability, inequality, governance failures, market-structure fragilities—are shaping beta and cannot be diversified away.

- Stewardship and investment strategy increasingly require system-aware analysis: understanding which systems portfolios depend on, and how portfolios influence those systems in turn.

- As with our earlier work on systems framing and complex adaptive systems, this report reinforces that investors must move beyond equilibrium assumptions and toward approaches grounded in feedback loops, interconnections, and evolving dynamics.

Why this matters

- It offers a practical, actionable roadmap for embedding systems thinking across investment beliefs, governance, portfolio construction, and stewardship.

- It speaks directly to the accelerating divergence in regulatory frameworks across the UK, EU, and US—and how asset owners can navigate that complexity.

- It provides clarity on how investors can operationalize system-wide stewardship in ways aligned with fiduciary duty and the pursuit of long-term value creation.

You can access the Railpen report here.

This release is part of a broader set of projects we completed this year that demonstrate how system-level investing is moving from concept to practice.

- The Rockefeller Brothers Fund 10-Year Total Portfolio Review, offering a rare longitudinal look at how a mission-aligned investor evolves its approach to systemic risks and opportunities. More here.

- A new suite of case studies with the High Meadows Institute, profiling how leading investors—PGGM, McKnight Foundation, Cambridge Associates, Wespath, Domini Impact Investments—are embedding systems thinking into investment management, stewardship, risk, and governance. More here.

- Chief Investment Officer op-ed series on System-Level Investing — Three-part exploration of how institutional investors are re-examining core assumptions and implementing system-level strategies: Part I (here), Part II (here), and Part III (here).

Across these efforts, the message is consistent: institutional investors are increasingly expected to understand and manage their influence on the systems that shape long-term performance.

As always, we welcome your reflections and would be glad to discuss the implications for your organization’s investment strategy, governance, or stewardship approach.

What can SAIL do for you?

TIIP’s next-generation, AI-enhanced platform helps institutional investors turn system-level investing from theory into practice.

Tell us your problem, SAIL just might be able to help.

From capital needs assessments for place-based investors to bespoke playbooks to take systemic stewardship programs to the next level. SAIL can do in hours what would otherwise take months.

Want a deep dive on a specific issue or intersection of risks to understand leverage points, capital requirements to mitigate the issue and understand the appropriate sequencing of actions to stabilize the risk or create long term value? Reach out, we can help!

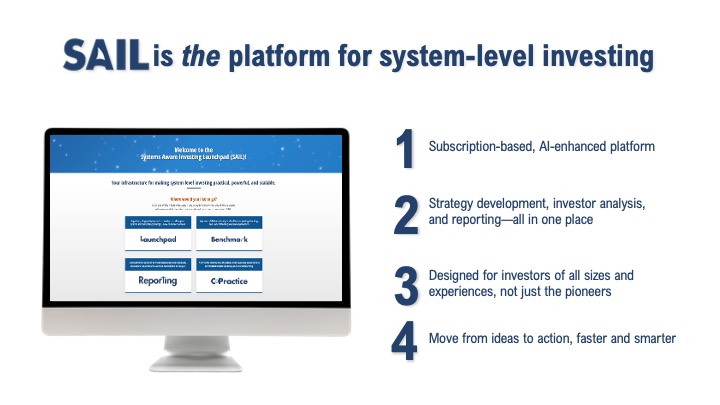

SAIL 2.0 brings the efficiencies of AI to systemic risk management, doing in hours what once took months: aligning strategy, benchmarking performance, structuring stewardship, and automating disclosure—through a systems lens.

What SAIL 2.0 does (at a glance)

- Turns data chaos into systemic risk intelligence: upload once; SAIL standardizes and interprets data, flags gaps, and surfaces next actions.

- Benchmarks what matters: compare peers, managers, and asset owners side-by-side to spot alignment gaps and high-performing outliers.

- Automates disclosures: reuse existing content for PRI, TCFD, stewardship codes, and more—cutting duplication and time.

- Structures strategies and stewardship: translate system-level goals into portfolio-wide construction and escalation pathways.

- Built for scale: roadmap toward fully proactive, agentic AI guiding systemic risk action across the investment lifecycle.

But wait, there’s more!

- Build a systems-aware strategy without starting from scratch

- Diagnostics that highlight strengths, gaps, and next-best actions in one click

- Peer/manager benchmarking that actually informs decisions

- Bring interoperability to mandatory or voluntary reporting to reduce survey fatigue and compliance burden

Why this is different

- No other platform integrates diagnostics, systemic frameworks, automated reporting, and benchmarking in one place—and does it with agentic AI purpose-built for institutional investors.

SAIL is not another dashboard; it is the intelligence and infrastructure layer the field needs for managing systemic risks, rooted in fiduciary duty.

We are already underway with enhancements to the platform, which will roll out in 2026. Our current promotional rate for new subscribers expires on December 31st. Reach out today to get next year’s capabilities at last year’s rate before it’s too late!

Expert View on Fiduciary Duty, Tiffany Reeves

This month’s featured video showcases the expertise of Tiffany Reeves, Partner at Faegre Drinker from the 4th Annual Symposium in New York this past April.

Session description below:

Much of the world’s investment capital is managed by fiduciaries—individuals responsible for making investment decisions on behalf of others while focusing on the best interests of the beneficiaries. These fiduciaries must adhere to strict ethical and legal standards, limiting their ability to invest based solely on personal preferences. The same principles apply to system-level investing. In this session, Tiffany Reeves, Partner at Faegre Drinker, explored the fiduciary duties that govern system-level investors and their decision-making responsibilities.

On the Radar

December 15, 2025 | Systems Stewardship: Managing Interconnected Climate Risks for Lasting Value by Investor Group on Climate Change (IGCC) and the Institute for Sustainable Futures

Climate change is driving system-wide financial risks that could undermine long-term returns across entire portfolios unless investors expand their stewardship approach beyond individual companies, according to this paper from the Investor Group on Climate Change (IGCC) and the Institute for Sustainable Future.

The report reveals that addressing climate-related risks requires interconnected action across entire markets, sectors, and economies — from grid constraints and supply-chain pressures to technology bottlenecks and policy uncertainty.

“Investors are seeing that complex and interdependent climate risks require systemic stewardship. When policy settings, infrastructure or supply chains fail to keep pace with the transition, it affects entire portfolios. Managing these exposures is part of prudent, long-term investing.” – Dr Donna Lopata, Corporate Engagement Manager at IGCC

Download the report here.

December 3, 2025 | Beyond Modern Portfolio Theory by Future of Finance Podcast

December 3, 2025 | Beyond Modern Portfolio Theory by Future of Finance Podcast

In this episode of The Future of Finance, host Georges Dyer sits down with Jon Lukomnik — investor, author, corporate governance pioneer, and one of the main architects of system-level investing. Drawing on his experience managing New York City’s pension funds in the 1990s, Jon recounts the moment he realized that traditional Modern Portfolio Theory (MPT) was no longer sufficient for investors responsible for real-world liabilities. The conversation traces his decades-long journey toward developing “beyond MPT” thinking, culminating in his influential book Moving Beyond Modern Portfolio Theory and the forthcoming Handbook on System-Level Investing.

Jon explains why the majority of investors’ returns are shaped not by stock picking, but by overall market performance — and why investors must understand, steward, and take action to support the health of social and environmental systems to manage systemic risk. He highlights real examples from global pension funds, insurers, and asset managers who are leading this shift, and discusses tools such as collaborative engagement, policy advocacy, and rethinking investment beliefs. Jon also tackles critiques of systemic stewardship, the politicization of ESG, the role of academia, and how system-level thinking can shape the future of finance.

Dive in here.

November 26, 2025 | From the Corporation to the System: Fixing the Rules of Markets by Future of Finance Podcast

November 26, 2025 | From the Corporation to the System: Fixing the Rules of Markets by Future of Finance Podcast

In this episode of the Future of Finance podcast, Georges Dyer sits down with Rick Alexander, CEO of The Shareholder Commons and a leading voice in system-level investing and system stewardship. Rick shares his journey from decades as a Delaware corporate lawyer to becoming one of the foremost advocates for rethinking the purpose of corporations and the role of investors in shaping sustainable markets.

They explore the core idea of universal ownership—the recognition that diversified institutional investors ultimately own the economy as a whole, not just individual companies. When a company boosts profits by externalizing costs onto society, the environment, or the broader market, it may harm the long-term returns of its shareholders’ entire portfolios. Rick explains why investors must move beyond traditional ESG arguments about company-level financial performance and instead use their “superpowers” as owners to steward economic systems, protect common goods, and reshape business culture.

Click here to have a listen.

October 29, 2025 | From Alpha to Systems: Rethinking System Stewardship by Future of Finance Podcast

In this episode of The Future of Finance, Sara Murphy — former Chief Strategy Officer at The Shareholder Commons and now Director of System-Level Investing at the Sierra Club Foundation — shares how investors can play a transformative role in addressing global sustainability challenges through system-level investing and system stewardship.

Sara challenges the traditional “alpha-first” mindset that rewards individual company performance at the expense of long-term market health. Drawing from the Freshfields Legal Framework for Impact and PRI’s Active Ownership 2.0, she explains why investors must manage not only company-specific risks but also the broader social and environmental systems that underpin portfolio value.

Take a listen here.

October 25, 2025 | What Will It Take for Asset Owners to Lead by Jake Barnett, Adam Matthews and Stephen Barrie

October 25, 2025 | What Will It Take for Asset Owners to Lead by Jake Barnett, Adam Matthews and Stephen Barrie

The Church of England Pensions Board, alongside Wespath, co-authored a white paper on ESG and Systems-Level investing which explores the way the ESG label has been oversold.

It goes on to explain why it is a key duty of pension funds to assess risks, as well as opportunities, that can be understood when looking through the lens of ESG. The article sets out what authentic leadership is in the context of sustainability and systems-level investing.

Read the paper here.

TIIP + Friends About Town

- January

- 1/30 – In the 2nd session of William and Jon’s graduate course on system-level investing at Columbia University, Adam Connaker, Director of Impact Investing at the Surdna Foundation, shared how Surdna aligns its century-long mission with policies that address systemic environmental and social challenges, Adam detailed how Surdna—via core programs on Inclusive Economies, Sustainable Environments, and Thriving Cultures—integrates impact-driven policies with financial prudence, breaks down systemic barriers, and builds strategic partnerships for a more equitable and sustainable future.

- February

- 2/6 – With guest speaker Rodney Foxworth, William and Jon’s graduate class on system-level investing at Columbia University examined how a fragmented system, leads to inefficiencies and challenges in capital markets. The session wrapped with a case study of the 2008-2009 Global Financial Crisis, shedding light on how the system’s gaps created profound ripple effects.

- March

- 3/6 – Guest speakers, Cambria Allen Ratzlaff (now interim CEO, Principles for Responsible Investment) and Beth Young (Consultant, CGSS-Corporate Governance and Sustainable Strategies LLC) joined William Burckart and Jon Lukomnik for their graduate course on system-level investing at Columbia University.

- 3/7 – William joined Just Investing Podcast hosts Adam Sank and Matthew Illian to explore how investors can drive systemic change and address global challenges on the for the episode entitled, “The Future of Systems-Level Investing”.

- 3/13 – One of the most pressing challenges (and opportunities) in system-level investing is progress assessment. Most investors rely on data, but system-level investors face a unique obstacle: current disclosure regimes focus on how external factors affect individual companies, not how companies impact essential systems. System-level effects—whether positive or negative—are often classified as externalities and either go unmeasured, are inconsistently tracked, or lack standardized assurance. So how can system-level investors evaluate their progress? To answer the question, the class was joined by Melissa Eng and Lazaro Tiant.

- 3/27 – For Session 8 of the graduate course on system-level investing at Columbia University, the team dove into fiduciary duty and materiality with Keith Johnson, CEO of Global Investor Collaboration Services, and Co-editor of the Cambridge University “Handbook of Institutional Investment and Fiduciary Duty,” to answer key questions like: What is material? To whom? And why? What is the difference between single vs. double materiality? Enterprise vs. Portfolio value? And, to explore the concept of dynamic materiality.

- April

- 4/3 – The class zoomed out to look at the global landscape: System-level investing is gaining momentum—and attracting scrutiny. With more than 130 jurisdictions enacting sustainability and ESG-related laws (and U.S. states both supporting and opposing them), the regulatory environment is dynamic and often contentious they covered the latest in standard-setting and adoption (ISSB, EU, PRI, CFA Institute, UK stewardship definitions, and more), the evolving role of policy, regulation, and enforcement and how institutional investors are beginning to integrate system-level thinking into their investing approaches. Corey Klemmer, CFA, Esq, former SEC Policy Director and former Director of Engagement at Domini Impact Investment, grounded the conversation in the realities of policy, regulation, and practice.

- 4/5 – TIIP’s 4th Annual Symposium on System-level Investing, “From Vision to Action Using a Total Portfolio Approach” launched the System-level Investing Awards honoring Erika Seth Davies, Takeshi Kimura and Steve Lydenberg. The program also featured the following leaders:

- 4/10 – In their final session before student teams presented their term-long projects, William and Jon, and their TA Tarunya Reddy, led a powerful “lessons learned” discussion with investors advancing system-level investing at scale. Panelists included: Takeshi Kimura of Nippon Life Insurance Company, Lynn Paquin of CalSTRS, Anna Snider of Bank of America, and Amar N. of Koppa – The LGBTI+ Economic Power Lab. They were joined by a number of alumni of the course Daniel Sheehan, Wangeci Wanyahoro, Erik Stein, and Noveena Padala.

- May

- May 7 – William was featured in the May issue of GOMAG in the article, “27 LGBTQ+ Leaders at the Helm“.

- May 15 – Monique moderated a conversation with Andre Perry, Senior Fellow and Director, Center for Community Uplift, Brookings Institution and Samantha Tweedy, CEO, Black Economic Alliance at a session during the Total Impact Summit 2025 entitled, “Tying Our Roots Together: A Radical Conversation on Shared Humanity”.

- June

- 6/24 – At this year’s Impact & Sustainable Finance Faculty Consortium in Chicago, TIIP’s William Burckart was joined by Randy Strickland, Jake Barnett and Donna Loveridge in a conversation entitled “System-level Investing”.

- July

- 7/8 – William launched his 3-part Op-ed series CIO magazine.

- August

- 8/4 – TIIP released the 10-Year review of the Rockefeller Brothers Fund Mission-Aligned Investing Journey.

- September

- 9/21 – William joined Monique and the team at Make Justice Normal to kick off NY Climate Week with Street Works Earth, their annual arts + climate festival in Jackson Heights, Queens. This year’s event added a career fair, Future @ Work, where Faiza Azam, Daniel Barker, Margot Brown, Rachel Castillo, Dalila Mujagic, Neha Savant, Aseante Renee, Donita Volkwijn, Ayesha Williams, and others shared their career journey.

- 9/22 – Monique facilitated a break-out session at the “Climate Change & Fiduciary Duty: System Stewardship in Theory and Practice” gathering organized by Sara Murphy of the Sierra Club Foundation.

- 9/22 – Curated by Kristy Drutman, Monique joined Daniel Carillo of Anthesis, Jessica Ajoku of Capricorn and Breene Murphy of Carbon Collective for the Climate Finance & Business Jobs session at the Green Jobs Pavilion 2025.

- 9/23 – TIIP and HMI released new case studies focused on how investors are tacking systemic climate risk featuring: PGGM, McKnight Foundation, Cambridge Associates, Wespath and Domini.

- October

- 10/9-10 – William joined Alex Woods of British International Investment, Tarik Perkins of Start Out, and Carla Sutherland of Justice Work for a conversation entitled “Lessons Learnt from Past LGBTIQ+ Efforts” at the Global LGBTIQ+ Inclusive Finance Forum, hosted by Koppa-The LGBTI+ Economic Empowerment Lab.

- 10/16 – William delivered the keynote address “A Call for Collective Action” at the Impact Summit America: Impact Investing Conference for Institutional Investors & Asset Owners.

- 10/21 – At the ICCR 2025 Fall Conference, Monique moderated a conversation between panelists Daryn Dodson of Illumen Capital, Chavon Sutton of Cambridge Associates, Lynne Hooey of Kataly Foundation and Rev. Sidney Williams of Crossing Capital entitled “System-Level Investing and the Future of Shareholder Advocacy,” which was curated by the Racial Justice Investing Coalition (RJI) and followed powerful opening remarks by Courtney Wicks of Movement Finance and RJI, and featured a closing appeal offered by Anandi Somasundaram of RJI.

- 10/27-28 – William attended the IEN Annual Forum where 100+ endowment, foundation, and sustainable investing industry leaders gathered and explored topics such as: Sustainable & System-Level Investing, Fiduciary Duty, Responsible Tech and AI, Climate Risk & Opportunity, Democracy & Political Risk, Inequality as Investment Risk.

- November

- 11/12 – William went to Zeist to join PGGM alongside the Sustainable Pension Investments Lab (SPIL) and the Principles for Responsible Investment (PRI) for a gathering of pension and insurance fund leaders focused on system-level investing.

- 11/18 – Monique joined Eric Krull of Northern Trust and Amar Nigam of Koppa for “Beyond Impact: Applying a System-level Lens to Investing” organized by Out In Finance.

- 11/19 – Across the country, more public funds are embracing a total portfolio approach—breaking down silos to understand how every decision, from manager selection to climate risk, connects to the bigger picture. William was joined by Lynn Paquin, Portfolio Manager at CalSTRS, and together they provided a joint keynote on system-level investing at Pension&Investment’s Public Funds Conference in Austin, TX. They explored why portfolio performance can’t exist in isolation—and how leading funds are redefining fiduciary duty through system-level thinking. Lynn shared how CalSTRS is putting this approach into practice to build portfolios that are resilient, sustainable, and designed for generations to come.

- 11/20 – The Federal Reserve Bank of New York hosted a hybrid event on fostering and improving markets channeling investments into under-resourced communities. Monique and William represented the System-level Investing Design Team sharing progress to date. They also invited other Design Teams to share their problem statement with them and explained how SAIL could produce a range of capital needs assessments to support effective place-based investing strategies.

- December

- 12/11 – Railpen, TIIP and Sinclair Capital released the co-authored report “Systemic Stewardship: The Financially Material Imperative”.

- 12/15 – William provided opening remarks at IGCC webinar launching the report “Systems Stewardship – Managing Interconnected Climate Risks for Lasting Value”. Other speakers included report co-author, Alison Atherton, Rebecca Ogg of Fidelity International and Rebecca Mikula-Wright of IGCC. The report concludes that investors need to engage with system-level risks – like climate change – that threaten market-wide returns, through systems stewardship, and provides practical recommendations to enhance systems stewardship practice.

Have questions about system-level investing? Email us at [email protected].