As we covered in a recent op-ed in Responsible Investor, in the fall of 2016, Amit Bouri, the CEO of The Global Impact Investing Network (GIIN), called on investors everywhere to commit capital to impact investing efforts aimed at meeting the UN Sustainable Development Goals (SDGs). The SDGs are a “universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity.”

In emphasizing the urgency of the challenge, Bouri wrote “that every investor not already involved make at least one SDG-focused impact investment—and [to] get started…immediately.” Thanks to efforts by the GIIN and others, a number of investors, including Aviva, PGGM and Sonen Capital, as well as the UNEP Financial Initiative and the Cambridge Institute for Sustainability Leadership, have begun to explore ways to align investment activities with them.

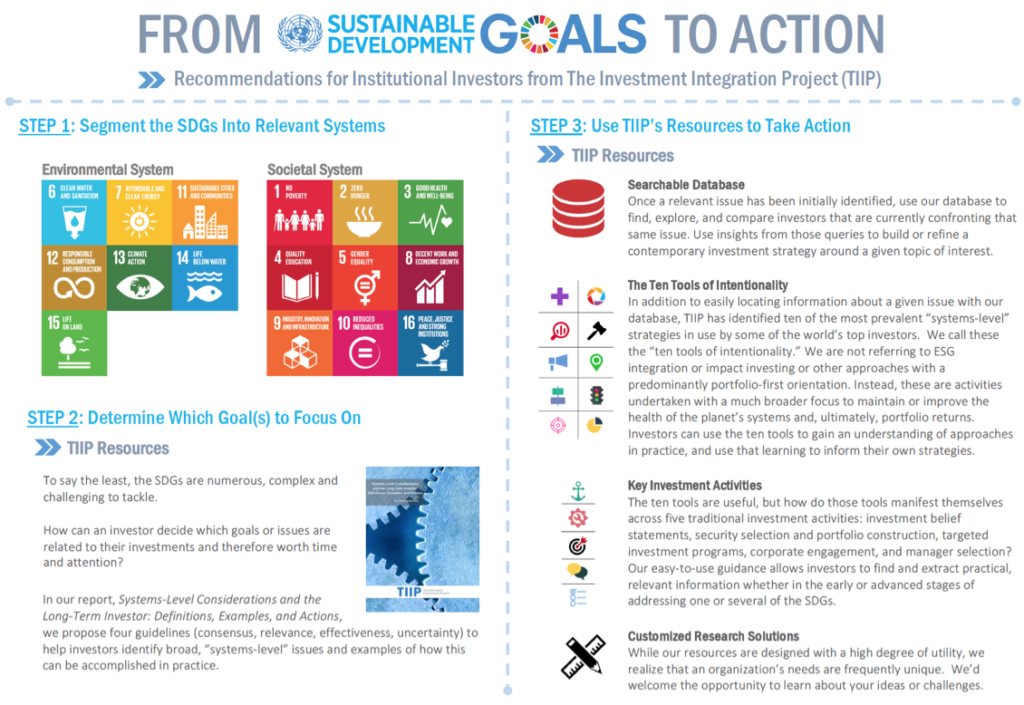

Although presented as goals, the SDGs have the characteristics of what we at The Investment Integration Project (TIIP) refer to as “systems-level issues.” By “systems” we mean the vast set of what are essentially common-pooled environmental and societal resources upon which civilizations have depended for thousands of years and upon which investors have been so reliant in creating long-term wealth.

For institutional investors concerned about the ongoing health of these systems (which TIIP categorizes as environmental, societal, and financial) and/or motivated by the SDGs, a major question raised by the increasing emphasis on the SDGs is: how does an investor actually implement them? To this end TIIP has created the following guide to make frameworks like the UN’s actionable.

Our tools are designed to be widely adoptable, but we would be glad to provide tailored support to institutional investors who would like to, for example:

- Conduct a systems-level “audit” of their investment strategies and activities

- Take a “deeper dive” to better understand or replicate the systems-level approach of a given investor that goes beyond the detailed but standardized analysis available in our database

- Design a targeted investment program on a given systems-level issue, such as climate change or human rights, based on the leading practices of the world’s top investors

- Develop an Investment Beliefs Statement that integrates systems-level considerations

- Create or enhance a manager selection process that is more considerate of systems-level issues

- Stay ahead of the curve, competitors, and broader impact and ESG market trends

TIIP’s customized solutions are available to investors with all levels of systems-level knowledge. Want to learn more? Contact William Burckart at [email protected]