Report Spotlight: System-level Investing: Case Studies of Investors Leading the Way

On April 14th, TIIP announced the release of its latest report, System-level Investing: Case Studies of Investors Leading the Way.

With the support of the Surdna Foundation, this report was developed as part of TIIP’s broader response to its industry needs assessment conducted in 2021 and 2022, which made clear that while stakeholders are concerned about the systemic nature of social and environmental issues and their connection to investment, there remains a deep need for more information and evidence to foster an accessible path for institutional investors to adopt system-level investing.

For this report, TIIP selected five investors known to be leading the way in acknowledging the importance of and incorporating system-level investing techniques to address systemic social and environmental risks and advance related solutions.

- California State Teachers Retirement System (CalSTRS), the largest teachers’ retirement system and second largest public pension fund in the U.S. with $315 billion in assets under management.

- Domini Impact Investments, a women-led investment adviser that focuses exclusively on impact investing, with a focus on forest and land use.

- Saint Paul & Minnesota Foundation (SPMF), the largest community foundation in Minnesota with $2 billion in assets under management.

- University Pension Plan (UPP), a jointly sponsored defined benefit pension plan created by and for Ontario’s university sector with $10.8 billion in pension assets.

- Wespath Benefits and Investments, a nonprofit pension fund and general agency of the United Methodist Church with over $24 billion in assets under management.

With these five investors as examples, a roadmap begins to form, charting a path for investors to incorporate system-level investing techniques. The case studies and analysis show a replicable order of operations and necessary set of ingredients that support this approach. These components are compiled in TIIP’s new SAIL platform, which provides in-depth guidance for investors to embark on their journey to becoming or strengthening their system-level beliefs and techniques.

Click here to download the report.

Recap: 3rd Annual Symposium on System-level Investing

Great feedback continues to pour in about the 3rd Annual Symposium on System-level Investing: Aligning Investor Policies, Programs and Practices to the System-level, which was co-hosted by TIIP, the U.S. Impact Investing Alliance, and Principles for Responsible Investment (PRI) and made possible with support from Domini Impact Investments LLC, Orrick, Herrington & Sutcliffe LLP, and the High Meadows Institute.

Here’s a “highlight reel” of the day:

Opening remarks

The symposium kicked off with an inspired analogy about a persian rug (you had to be there) from Rekha Vaitla, Investment Officer – Sustainable Investment and Stewardship Strategies @ California State Teachers Retirement System (CalSTRS), a SAIL subscriber.

System-level Investing Takes Flight

TIIP’s William Burckart provided a level-set on system-level investing, highlights from investors’ applying the approach, and an overview of TIIP’s latest publications. As he said, “welcome to the next evolution in finance — join us.”

What Investors Look for in OCIOs and Investment Managers

Cambria Allen-Ratzlaff, Chief Responsible Investment Ecosystems Officer for the Americas + APAC, PRI, moderated a candid conversation on the needs of asset owners between Brian Minns, Senior Managing Director, Responsible Investing, University Pension Plan (UPP), Shannon O’Leary, CIO, Saint Paul and Minnesota Foundation, a SAIL subscrber, and Rajith Sebastian, Head of ESG and Sustainable Investing, New York State Insurance Fund.

Rapid Fire Round: 1

Lazaro Tiant, Investment Director for Sustainability @ Schroders, opened the dialogue on the opportunities and challenges of data and analysis with a systems lens. A subsequent conversation between Lenora Suki, Senior Advisor & Consultant @ Renaissouk LLC, and Jim Hawley, Professor Emeritus, School of Economics and Business @ Saint Mary’s College of California & Co-author, Moving Beyond Modern Portfolio Theory: Investing That Matters took up the mantle and further charged up the room.

Meeting Client Demand

Jake Barnett, Managing Director of Sustainable Investment Strategies @ Wespath Benefits and Investments, aSAIL subscriber, guided a candid discussion with Ibrahim Rashid, Sustainable Investing Research Analyst @ Marquette Associates and Chavon Sutton, Senior Investment Director, Sustainable & Impact Investing Research @ Cambridge Associates. The discussion examined the motivations, incentives, and opportunities that OCIOs encounter when creating system-level investing programs.

The Status of Industry Development

TIIP’s Monique Aiken moderated a lunchtime fireside chat on the headwinds and tailwinds for system-level investing. She was joined by Steve Lydenberg, Founder and Chairman @ TIIP, Partner, Strategic Vision @ Domini Impact Investments, Co-Founder @ KLD Research & Analytics, and Co-author of 21st Century Investing: Redirecting Financial Strategies to Drive Systems Change; Jon Lukomnik, Managing Partner @ Sinclair Capital, TIIP Advisory Board Member, and Co-author, Moving Beyond Modern Portfolio Theory: Investing That Matters; and Fran Seegull, Executive Director @ Tipping Point Fund on Impact Investing, and the President @ U.S. Impact Investing Alliance.

Rapid Fire Round: 2

Edgar Romney, Jr., SVP, Chief Strategy and Administrative Officer @ Amalgamated Bank and Piers Hugh Smith, Head of Stewardship, Global @ Franklin Templeton both expounded on the ways their institutions balance alpha and beta return expectations.

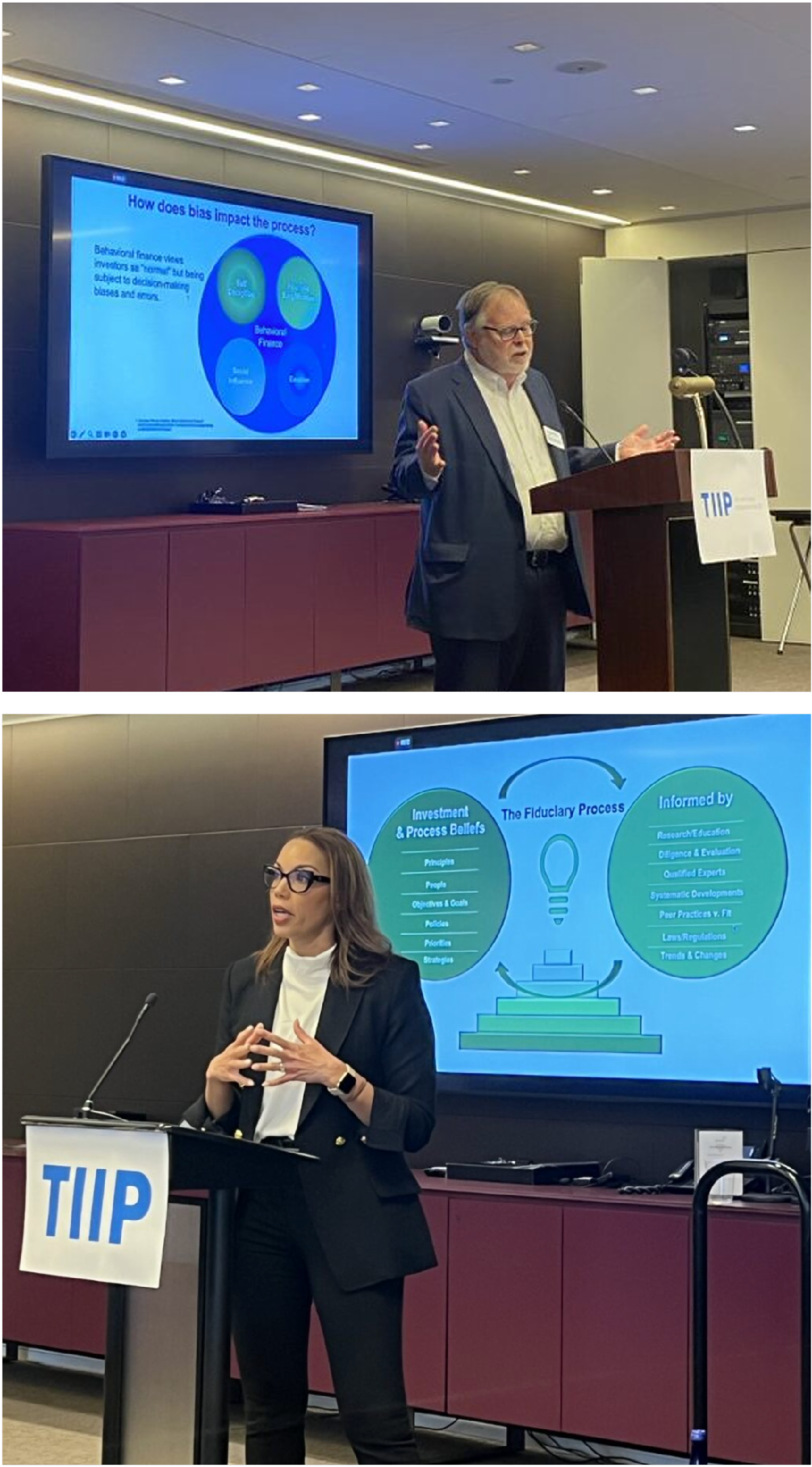

Making the Fiduciary Duty Case

Making the Fiduciary Duty Case

Tiffany Reeves, Partner @ Faegre Drinker and Keith Johnson, Chief Executive Officer @ Global Investor Collaboration Services, two of the foremost legal minds on fiduciary duty, shared a riveting discussion on how and why fiduciary duty evolves over time through an exploration of the relevance and nuances of duties that support investors’ ability to respond appropriately to material risks and opportunities that derive from global systemic challenges.

A key highlight: they made clear how fiduciary duties require investors, among other things, to balance systemic risks and use longer time horizons that connect investment considerations with the timelines of beneficiaries across multiple generations.

Learning Lab

The day wrapped up with the “Learning Lab” on Implementing System-level Investing covering 10 key dimensions of practice. The interactive session was facilitated by TIIP’s Billy Gridley, who also led the discussion on Strategy and Implementation. Perry Teicher, Impact Finance Counsel @ Orrick, led a conversation on Fiduciary Duty; Jessie Duncan, Program Officer @ Tipping Point Fund keyed in on Data and Analysis; TIIP’s Melissa Eng wrestled with Measurement and Reporting; and Delilah Rothenberg, Founder @ Pre-Distribution Initiative, focused on Standard Setting.

The last 5: Joanne Bauer, Co-Founder @ Rights Co-Lab led a discussion on Materiality, Courtney Wicks, Executive Director @ Investor Advocates for Social Justice focused on the role of Industry Associations; Lisa Lindsley, Founder @ KarmaKapital took on Stewardship; Will Sullivan, Senior Policy Analyst, US @ PRI focused on the Enabling Policy Environment now needed; and Anjali Deshmukh, Co-Founder @ Make Justice Normal, Co-Founder @ Savaan Blue, Senior Advisor, Impact Accountability @ Prime Coalition guided the conversation on Efforts Addressing Systemic Social Risks.

Thanks to all of our speakers for sharing their insights and to all who made time in their busy schedules to join us in person or on the Zoom. You all made it a symposium to remember!

2024 Symposium Speakers

SAIL Updates

SAIL Updates

Given the success of our first 1-day virtual intensive on system-level investing this past March, we are beginning to nail down plans for mid-July. Are you interested in attending? Registration will open soon.

Email us at [email protected] to learn more.

For those who are not yet familiar, SAIL (the Systems Aware Investing Launchpad) is not just another enterprise management platform. It’s a comprehensive solution that equips you with practical tools, templates, guidance, and deep research on systemic issues. With SAIL, you can implement or refine your system-level investment strategies, all with the goals of reducing costs, winning business, preserving long-term returns, and staying informed. It’s a game-changer for investors like you.

Ask us how to subscribe at our spring promotional rate!

Want access to the just to CoPractice (which will always remain free) or receive a live demonstration? Contact TIIP at [email protected].

TIIP + Friends About Town

- March 21: TIIP’s CEO, William Burckart, visited Sydney to speak at the Impact Investment Summit Asia Pacific.

- April 19: TIIP’s Managing Director, Monique Aiken, was interviewed by Social For Good, to kick off their new Social Impact Heroes series. Read the profile here.

- April 23: Andrea Longton published the book The Social Justice Investor: Advance Your Values While Building Wealth, Whether a Few Dollars or Millions, which provides personal finance guidance for both consumers and investors. The author weaves inspiring vignettes throughout the book, including a piece from Monique Aiken on how the name of her nonprofit collective, Make Justice Normal, came to be.

Here’s where you can catch the TIIP team in the weeks ahead:

- May 7 – William and Melissa Eng will share findings from TIIP’s latest report “(Re)Calibrating Feedback Loops” on a webinar with the IEN community at 2pm ET.

- June 17 – Willam will provide an “Introduction to System-level Investing”, on a webinar for the Impact Driven Finance Initiative (IDFI), an investor network based in Japan. A big thank you to TIIP Advisory Council Member Yuko Koshiba!

- June 17 – TIIP’s Melissa Eng will be at GreenFin 24 to speak on a panel entitled, “Making Sense of System-level Investing”. You’ll also see Monique during one of their signature 60 second “Big Little Talks”.

- June 20 – William will lead a system-level Investing education and training Intensive in Melbourne, Australia, co-hosted by PRI and Impact Investing Australia. A big thank you to Rosemary Addis for her leadership (both in Australia and globally)!

- June 26-28 – William will attend the 2024 Convening of the Impact and Sustainable Finance Faculty Consortium in Singapore.

Lastly, the book 21st Century Investing: Redirecting Financial Strategies to Drive Systems Change, co-authored by TIIP’s William Burckart and Steve Lydenberg, is now available in audiobook format on the Google Play Store. Check out a preview and purchase here.