Report Spotlight: (Re)Calibrating Feedback Loops

Report Spotlight: Conventional Portfolio Management Tools in Practice

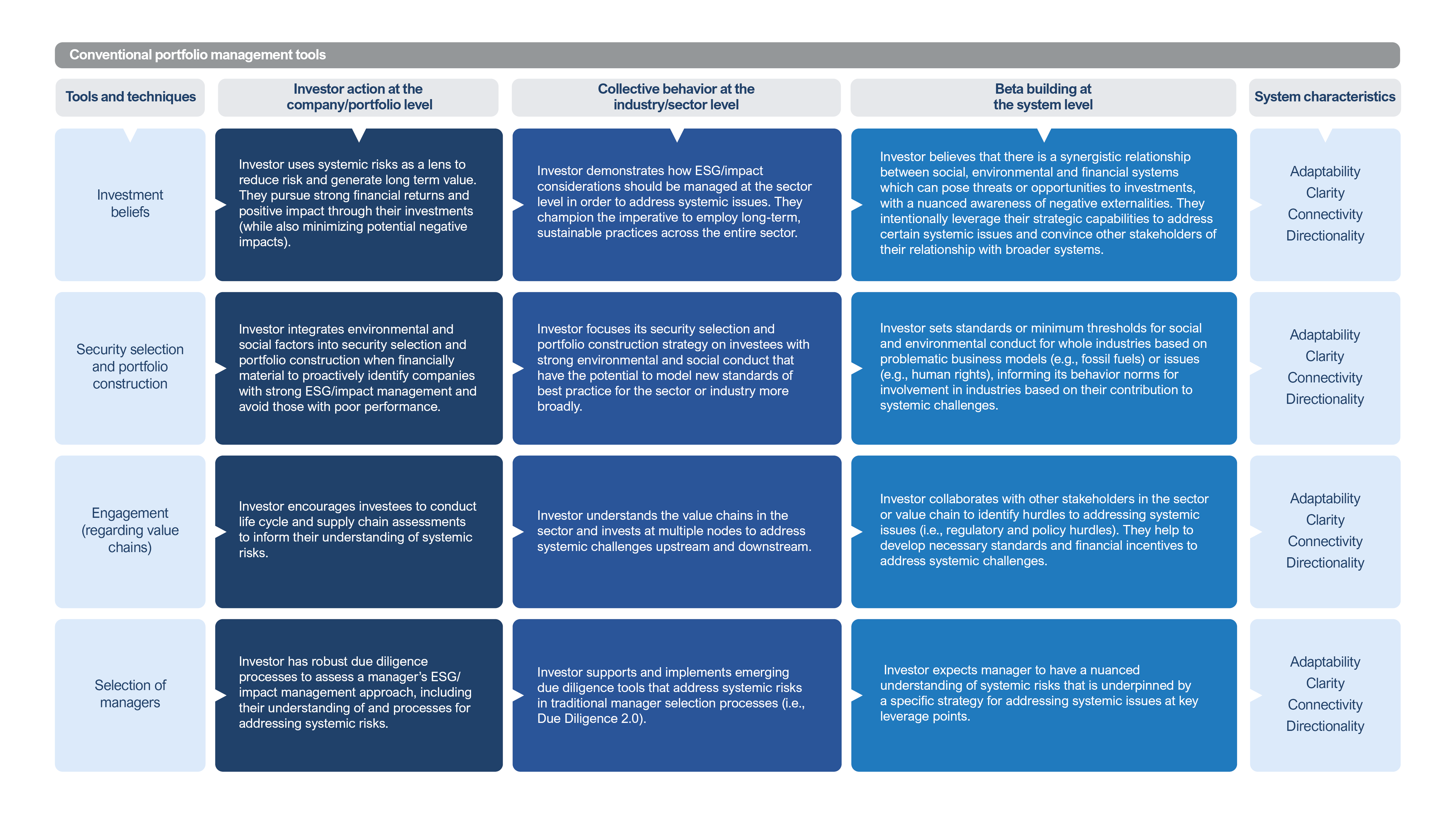

Conventional portfolio management tools are well-understood as being useful for managing risks and rewards at the portfolio level, but they can also be useful in a system-level investing context: investors can reflect systemic concerns in investment beliefs, emphasize systemic issues in security selection and portfolio construction, engage with holdings about systemic issues, and evaluate and select managers based on their consideration of systemic issues.

The table below from the (Re)Calibrating Feedback Loops report shows how to extend conventional tools across the investment process—investment policy and belief statements, investment strategy documentation, security selection and portfolio construction, engagement and activism, themed and targeted investments, and manager selection and monitoring—to exert influence on characteristics of system health.

The (Re)Calibrating Feedback Loops report includes three additional tables that lay out how to align more advanced techniques related to field building, investment enhancement, and opportunity generation with desired system-level progress. These techniques serve to enhance any given organization’s ability to pool resources and act collectively, develop a shared knowledge base regarding systems’ complexities, and work to assure alignment of investors’ goals with those of government and other influencers of public policy and vice versa. Download the report for more.

1-Day Intensive on System-level Investing

We’ve been listening to feedback from investors and are thrilled to introduce a 1-day intensive experience on March 12. The program will provide a shorter yet impactful option alongside TIIP’s well-established seven-month investor cohort program, as well as the graduate course that TIIP CEO William Burckart teaches with Jon Lukomnik at Columbia University | SIPA (a course that was co-created with Caroline Flammer, the director of Sustainable Investing Research Initiative (SIRI)).

Participants will learn:

- What it means to manage system-level risks and rewards;

- Why it is imperative to do so now; and

- How to extend their current investing practice to the system-level

TIIP is now accepting Expressions of Interest for this 1-day virtual intensive on system-level investing to be held on March 12, 2024 from 9.30am-5pm ET.

Please click here or use the QR code in the image to complete the form expressing your interest in joining the course.

The deadline for submissions of interest has been extended to February 29, 2024 @ 5pm ET or when we reach capacity.

Tuition for the course is $700 per person which includes:

- 8 live modules taught by the TIIP team, who will be joined by special invited guests

- 2-months of access to the SAIL platform (a $600 value) including the Launchpad (a strategic planning tool), Benchmark (the data management tool used to support diligence efforts), and the CoPractice (the open-to-all community of practice) components which comprise the platform.

Space in the course is limited. Participants will be notified of their acceptance to the program on a rolling basis. All others who cannot be accommodated in this course will be added to the waiting list for a future course. Apply today!

Interested in sending 2 or more people to the course? Reach out to Monique Aiken at [email protected] for information on the group rate.

Thought Leadership from the Field

Billy Gridley‘s piece at ImpactAlpha discusses some of the systemic stewardship and systems risk issues at several levels that he associates with “The Magnificent Seven”, the global American Big Tech companies.

The title of this piece by Sophie Robinson-Tillett in Investment & Pensions Europe (IPE) says it all: “Asset owners warn managers to take climate pledges seriously”. The article covers the release by the Net Zero Asset Owner Alliance (NZAOA) of a call to action to asset managers to “deliver on ambitious climate strategies that guide portfolio management, public affairs, and stewardship activities like proxy voting and engagement. This applies to both private and public asset classes—requiring integrated, tailored strategies to ensure insights and activities across all asset manager functions pursue the science-based outcomes.” Read the call to action here.

Some key quotes from the IPE article that come from Patrick Peura of Allianz and Jake Barnett of Wespath Benefits and Investments:

- “We need to see that same conviction at asset managers, and right now I’m not sure it’s always there…There are still some stewardship teams sitting in the corner, struggling to fight the good fight, while senior leadership fails to integrate their climate objectives into their broader business strategy.” (Patrick)

- “If you’ve made a commitment to be a net-zero asset manager and you look at this and decide it’s too resource-intensive, then there’s room for you to walk back from that commitment…And then asset owners can take that into account when they’re awarding mandates.” (Jake)

A new paper out from the Financial Markets Law Committee in the UK that clarifies the scope and need for trustees to act on systemic issues (like climate change). This work helps reinforce that consideration of systemic risks by investors is part of fiduciary duty. Some key points:

- “What might previously have been regarded as non-financial returns or risks may now need to be recognised as financial returns or risks or as relevant to financial returns or risks.

- “It may be necessary to consider whether a strategy should reject shorter term gains because they create identifiable risks to the longer term sustainability of investment returns in the fund.

- “Whereas some wider economic or systemic climate change-related issues may have been characterised as “too remote and insubstantial” in the past, pension fund trustees will need to reappraise this in a context where, for example, physical, transition and litigation risks are now apparent and material.

- “With climate-change related risks that are systemic, it is unlikely that diversification alone of a portfolio will be enough to avoid all the risks in the same way that non-systemic risks might be diversified away from.”

You can read the paper here.

SAIL Updates

SAIL is a SaaS platform that provides practical tools, templates, guidance and deep research on systemic issues to help investors implement or refine system-level investment strategies – all with the goals of reducing costs, winning business, preserving long-term returns, and staying informed.

SAIL is now open for subscribers. Ask us about our spring promotion!

To support investors in extending or adapting existing policies, programs or practices to the system-level, TIIP developed seven hypothetical (but based on TIIP’s consulting with investors) scenarios, which are housed in the CoPractice component of the SAIL platform.

These scenarios illustrate the nature of these transitions through such things as the re-thinking of purpose, the expansion of their risk management techniques, and the use of tools designed explicitly for system-level influence.

The case studies are now also available on the Resource page of the TIIP website through the links below.

- How a Pension Fund Transitions to the System-level

- How a Diversified Financial Services Firm Transitions to the System-level

- How a Family Office Transitions to the System-level

- How a Private Equity Firm Transitions to the System-level

- How a Investment Consultant Transitions to the System-level

- How a Foundation Transitions to the System-level

- How a Insurance Company Transitions to the System-level

Want to subscribe to the CoPractice (which will always remain free) or receive a live demonstration? Contact TIIP at [email protected].

TIIP + Friends About Town

January 31: Monique Aiken, William Burckart, and Melissa Eng gave the closing keynote on “Systems-Level Thinking for Systems-Level Resilience” at the Impact Investing Institute hosted by the Minnesota Council on Foundations. The talk highlighted TIIP’s latest report on (Re)Calibrating Feedback Loops. An essential component of the framework is ensuring that an investor’s policies, programs, and practices are aligned with their overarching system-level goals—do all actions work in the direction of a healthier and more resilient system? Download the report here. A big thank you to Susan Hammel, Susie Brown, Paul Masiarchin and the team at the Council for their leadership.

February 1: William Burckart joined Otho Kerr of the Federal Reserve Bank of New York, Marisa Hodgdon of Ember Ignite and Sidelines, and Fabrice C Houdart of the Association of LGBTQ+ Corporate Directors and Fabrice Houdart Consulting for a panel on Inclusive Capital, with an emphasis on advancing LGBTQIA+ progress. The session was moderated by Caroline Flammer (the director of Sustainable Investing Research Initiative (SIRI) and William’s boss at Columbia University when he is “professoring”). A big thank you to all the students and attendees, fellow panelists, the co-sponsors Out in Finance and SUMA Equity Alliance for their support and for fostering greater inclusiveness, and to the student club Columbia Impact Investing Initiative for co-hosting this event last week. Stay tuned to SIRI and Colorful Capital for more.

February 6: William Burckart joined Alan Hsu (Portfolio Manager, Wellington) and David Loehwing (Head of Sustainability and Stewardship, North America, Impax Asset Management) for the Wespath Investment Forum for a panel entitled “The Rise of Systemic Risk and the Impact of Sustainable Investment Strategies”. The session, moderated by Jake Barnett (Managing Director, Sustainable Investment Strategies, Wespath), focused on how institutional investors are working together to address systemic risk in their portfolios through innovative sustainable investment strategies.

Here’s where you can catch the TIIP team in the weeks ahead:

- February 21st – William is set to guest lecture (virtually) at the School of Systems Change.

- February 29: Monique will speak at Majority Action’s webinar “Equity in the Boardroom: Proxy Voting to Advance Racial Equity, Democracy, and a Thriving Economy for All” – on Thursday, February 29th at 2 PM EST. Register to attend here.

- March 6th – William and Jon Lukomnik, managing partner of Sinclair Capital, will once again kick off and lead the graduate course on system-level investing at Columbia SIPA.

- March 12th – TIIP will host its 1-day virtual intensive; more details on how to apply can be found here.

- March 20-21 – William will speak at the Impact Investment Summit Asia Pacific.

- March 25th – William will be a panelist at the Africa Value Creation Summit in New York City, alongside the Global Private Capital Conference in partnership with IFC.

- May 7 – William and Melissa Eng will share findings from TIIP’s latest report “(Re)Calibrating Feedback Loops” on a webinar with IEN.

Stay tuned for more details on TIIP’s upcoming 3rd annual gathering on system-level investing in April.