|

Op-ed on measuring the effectiveness of investing in global goals; Interview with Jonathan Bailey and Robert Eccles on long-termism and the SDGs; A new study by Toniic on investors aligning with the SDGs; and the emergence of “the third stage of corporate governance” by James Hawley and Jon Lukomnik

In a report released in March, TIIP and the IRRCi provided guidance on how investors can begin to assess their influence in determining changes on global environmental and societal systems and the potential contribution of their efforts and investments. In an op-ed in NextBillion titled “It’s Time to Measure the Effectiveness of Investing in Global Goals” we explore that while some investors report how their investments relate to specific SDGs, they are not necessarily attempting to influence overall progress toward achievement of the goals or measuring the effectiveness of such attempts. From the op-ed: “So, in the case of climate change, the current challenge stems not simply from the fact that fossil fuels emit greenhouse gases. Rather, there is a more complex dilemma in that our global economic system is so dependent on fossil fuels as its predominant source of energy that it cannot adjust rapidly enough to prevent climate change from occurring. By changing the paradigm for energy production not only to renewables, for example, but to a diverse set of fuel sources, investors can create a system capable of adapting to unanticipated challenges. In this way, investors can influence the larger system so that it will not simply replace dependency on fossil fuels with dependency on another predominant source of energy.” |

| In case you missed it!

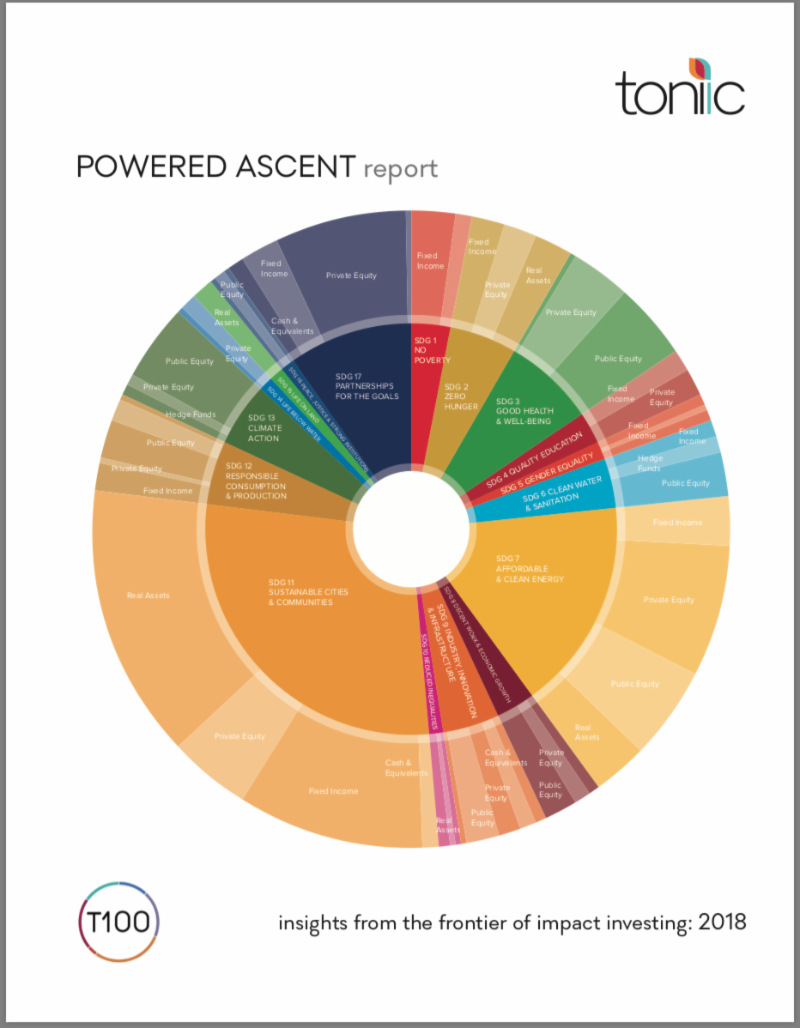

The following resources – interview with Jonathan Bailey and Robert Eccles on long-termism and the SDGs, a new study by Toniic on investors aligning with the SDGs, and the emergence of “the third stage of corporate governance” by James Hawley and Jon Lukomnik – serve as additional tools for system-level investors. |

|

|

|

|

| About The Investment Integration Project. TIIP helps institutional investors understand the feedback loops between their investments and the planet’s overarching systems – be they environmental, societal or financial – that make profitable investment opportunities possible. Once this relationship is understood, TIIP provides investors with the tools to help manage the impacts of their investment policies and practices on these systems. More information is available at https://tiiproject.com |