Reporting Doesn’t Have to Be a Burden – With SAIL, it Becomes a Bridge

Across the sustainable and impact investment landscape, dozens of frameworks—PRI, GRESB, ISSB, SFDR, GIIN, CSRD, the UK Stewardship Code—are asking for many of the same things in slightly different ways.

Across the sustainable and impact investment landscape, dozens of frameworks—PRI, GRESB, ISSB, SFDR, GIIN, CSRD, the UK Stewardship Code—are asking for many of the same things in slightly different ways.

But, if you’re a pension fund, foundation, investment consultant, or asset manager trying to demonstrate progress on system-level goals, that fragmentation creates serious drag.

That’s why SAIL was built for interoperability. Create your system-level profile once—and use it everywhere.

Bundled SAIL subscriptions are now available—but so are unbundled subscriptions for specific features, including reporting only. Whether you’re looking to meet today’s disclosure mandates on portfolio-level ESG and impact investing performance, or aiming to elevate your strategy to address system-level risks and opportunities, SAIL helps you do both—without duplicating effort.

Just want to kick the tires? We’ll can run a single report for you — PRI, GRESB, ISSB, or custom framework of your choice — for just $500. This is a perfect way to test-drive SAIL or support internal benchmarking before moving to broader subscription

Now Live! Match the Framework to the Role – Streamline the Rest

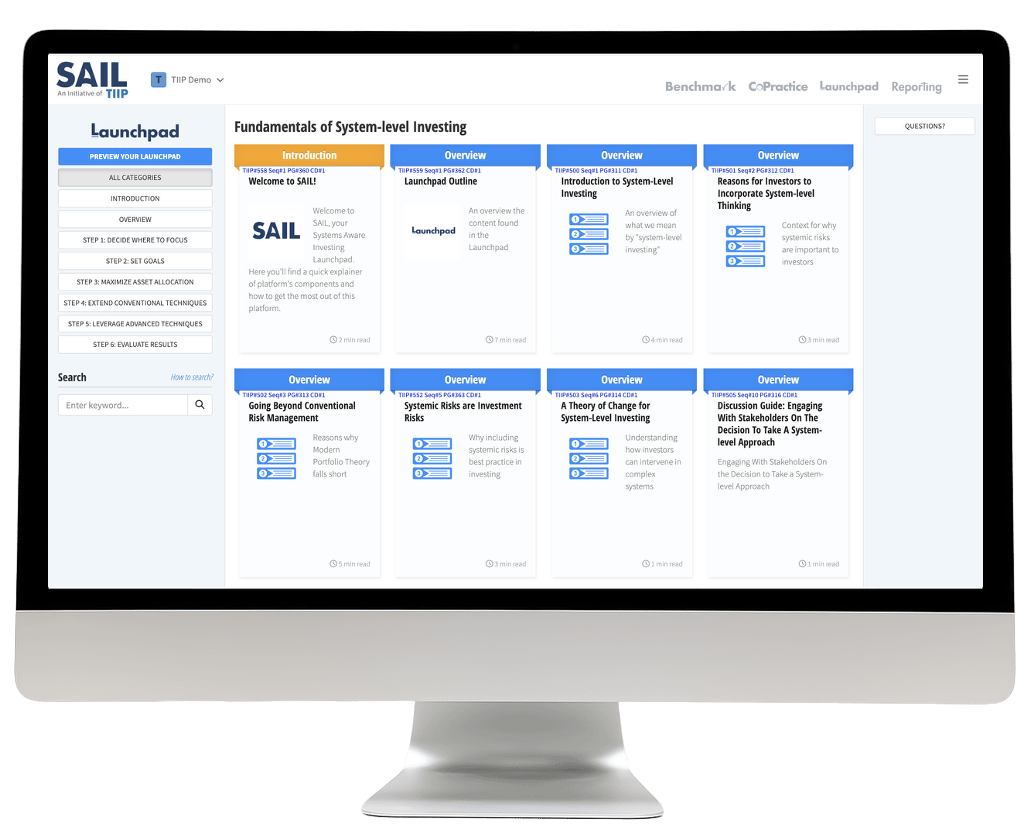

TIIP is excited to announce a new wave of features and data within SAIL, our subscription-based, AI-enhanced platform for investors.

This month, we’ve released new tools in SAIL that help users match the right frameworks to their role—and then auto-populate those frameworks using their SAIL profile. Here’s how it works:

🔷 For Asset Owners (e.g., pension funds, endowments, foundations)

- Use: ISSB (S1/S2), GRI, PRI, UK Stewardship Code, TIIP Framework

- Streamline: Long-horizon goals, mission alignment, stewardship reporting, SDG integration

- SAIL Syncs: PRI Strategy & Governance, OPIM, NZAOA disclosures

🔶 For Asset Managers / Fund Managers

- Use: IRIS+, GIIN Impact Principles, OPIM, SFDR, ISSB

- Streamline: alignment with impact principles, ESG integration, Article 8/9 compliance, client trust

- SAIL Syncs: Fund strategy statements, GRESB Asset & Fund Modules, IRIS+ KPIs, IMP mapping

🔷 For Foundations & Mission-Driven Investors

- Use: SDG Impact Standards, GRI, TIIP Framework

- Streamline: Impact narratives, grantee alignment, system-level theory of change

- SAIL Syncs: RPA impact strategy templates, ImpactAssets50 profiles, custom narrative disclosures

🔶 For DFIs & Multilaterals

- Use: SDG Impact Standards, IRIS+, OPIM, Just Transition frameworks

- Streamline: Policy alignment, blended finance, catalytic capital reporting

- SAIL Syncs: SDG mapping, system-level contribution diagnostics, public transparency tools

🔷 For Operating Companies / Corporates

- Use: ISSB (IFRS S1/S2), GRI, CSRD, CDP

- Streamline: ESG disclosure, stakeholder accountability, climate risk reporting

- SAIL Syncs: Materiality assessments, scenario inputs, strategy alignment statements

📧 Reach out at [email protected]

How SAIL Powers Interoperability

Once a user completes their core profile in SAIL, the platform does the heavy lifting:

- Auto-populates relevant sections of frameworks like PRI, GRESB, SFDR, ISSB, IRIS+, and more

- Harmonizes supporting documentation (e.g., fund narratives, policy statements)

- Prepares disclosures tailored to specific institutional roles and responsibilities

💡As covered at TIIP’s Symposium earlier this year:

“Already submitted to PRI, BlueMark Fund ID, IEN, or ImpactAssets50? Using any of the other voluntary disclosure frameworks or emerging regulatory standards? SAIL improves interoperability—by harmonizing data to populate your profile. No need to do the same homework two times, three times, four times…You get the idea.”

📧 Reach out at [email protected]

We’ve already started demos with early adopters—including CalSTRS—and are onboarding our first wave of subscribers now. This July and August, we’ll continue roadshowing SAIL to potential subscribers and TIIP cohort participants.

We’ve already started demos with early adopters—including CalSTRS—and are onboarding our first wave of subscribers now. This July and August, we’ll continue roadshowing SAIL to potential subscribers and TIIP cohort participants.

If you’d like a walkthrough, or to explore how SAIL can meet your organization’s specific framework needs, let’s talk.

Follow us on LinkedIn to keep up with the latest TIIP news and find out how to join the system-level investing movement. Have questions about system-level investing? Email us at [email protected].