Featured Video: Celebrating Visionary TIIP Founder, Steve Lydenberg Risks

At this year’s 4th Annual Symposium on System-level Investing, we were proud to honor TIIP Founder, Steve Lydenberg, with the inaugural Visionary Award for System-level Investing, recognizing his pioneering contributions that have opened new frontiers in finance.

This month, as Steve prepares to retire from Domini Impact Investments, we are pleased to share the video of his award presentation—a tribute to the profound influence he has had on both TIIP and the broader field of sustainable finance.

Through his decades of work, Steve has helped evolve responsible investing from an effort to clean up individual portfolios into a movement to reshape the systems that define economic outcomes.

Excerpt from the video:

Steve once said that financial tools offered “a more orderly way of bringing these issues to the public’s attention—and to actual transformative change. We celebrate not only his groundbreaking ideas, but his unwavering commitment to making that change real. Please join me in honoring Steve Lydenberg—visionary, pioneer, and the inaugural recipient of our System-Level Investing Visionary Award.” – TIIP

On the Radar

Reframing Financial Markets as Complex Systems: Tools for Systemic Risk Analysis, Portfolio Management, and System-Level Investing

by @ Genevieve Hayman, Phd and Raymod Ka-Kay Pang, Phd – CFA Institute, October 21, 2025

Earlier this year, William Burckart and TIIP Advisory Board Member, Jon Lukomnik co-authored “Tools Used by System-Level Investors in Their Net-Zero Initiatives” with the CFA Institute, which examined how leading investors are using system-level tools to address climate and broader systemic risks.

This new publication by CFA Institute picks up that thread — moving from tools and net-zero implementation to a broader conceptual reframing of markets through a systems lens.

What this means for asset owners, OCIOs, consultants, and advisors

- The traditional equilibrium mindset (“markets revert to the mean; diversification solves most things”) is no longer sufficient in a world defined by structural shocks, networked disruptions, and systemic tipping points.

- Embedding systems awareness means asking: Which systems — financial, social, environmental — does your portfolio depend on, and how do you influence them?

- As the earlier CFA Institute work showed, system-level investors are distinguished not only by what they invest in, but by how they invest — their investment toolkits, governance, and stewardship orientation.

Why this matters

- Financial markets today operate as dense, dynamic networks of participants, technologies, and information flows — not as neat statistical abstractions.

- The paper introduces approaches such as agent-based modeling and network theory (closely aligned with TIIP’s systems-thinking and problem-framing focus) that open fresh pathways for risk management, portfolio strategy, and macro oversight.

- For professionals trained on CAPM, equilibrium pricing, or normal distributions, this signals a shift: the landscape is changing — and so must the mindset.

The TIIP Take

- At TIIP, we’ve been working on exactly these ideas — helping investors frame decisions not as isolated acts, but as interventions in an adaptive system. We are honored that our work was cited in the report. Indeed, we believe:

- Scenario thinking that incorporates network contagion and regime shifts will become mainstream.

- Portfolio construction that accounts for shock propagation and structural fragilities will outperform models based on “average behavior.”

- Investment education and professional development will increasingly emphasize complexity, systems literacy, and non-linear quantitative methods.

We encourage you to read and share the report — it’s an important signal of how the industry’s intellectual foundations are evolving.

Download the report here.

PRI Appoints Cambria Allen-Ratzlaff Interim CEO

by @ ESG news, October 21, 2025

The Principles for Responsible Investment (PRI) announced that Cambria Allen-Ratzlaff will become Interim Chief Executive Officer effective December 1, 2025, succeeding David Atkin.

Read the full press release here.

System-level Investing with William Burckart

by @ The Future of Finance Podcast, October 15, 2025

Host Georges Dyer speaks with William “Bill” Burckart who explains the concept of system-level investing—a strategic approach that helps investors protect and shape the critical systems (like climate stability, fair labor markets, and democracy) that underpin long-term portfolio performance.

The conversation explores why modern portfolio theory is no longer sufficient in the face of systemic risks like climate change and inequality, and how fiduciaries can—and must—integrate systems thinking into investment strategies. Bill outlines practical tools and frameworks for implementation, including the CRIM test for identifying systemic issues and the SAIL platform for assessing institutional readiness. He highlights real-world examples from University Pension Plan Ontario, CalSTRS, and the Rockefeller Brothers Fund, showing how strong financial performance and positive system-level influence are mutually reinforcing.

Have a listen here.

How Inequality Hurts the Market — and What Investors Can Do About It | Columbia Professor Explains

by @ HBS Institute for Business in Global Society, October 15, 2025

Jon Lukomnik, adjunct professor of sustainable investing at Columbia University, breaks down how inequality weakens the economy, prolongs recessions, and amplifies market risk. He outlines the four key indicators of systemic risk, highlights how investors are focusing on reducing inequality, and challenges business schools to connect theories to the realities of the market.

Watch the video here.

System-Level Finance: How Pension Plans Can Drive Sustainability with Brian Minns

by @ Future of Finance Podcast, October 1, 2025

George Dyer sits down with Brian Minns, who leads Responsible Investing at the University Pension Plan of Ontario (UPP). [Full disclosure: UPP is a past client of TIIP.] With more than $12 billion in assets under management and a strong commitment to sustainability from its inception, UPP is charting a bold course for system-level investing.

Brian shares how UPP approaches responsible investing through a fiduciary lens, balancing the dual role of protecting pension assets while contributing to the global transition toward a sustainable economy. The conversation explores UPP’s climate action plan—including a net-zero by 2040 target—its work with external managers, investment in climate solutions, and the critical role of policy engagement.

Brian also reflects on his two decades in the field, the challenges of fiduciary duty and ESG language, the opportunities in renewables and climate solutions, and his vision for finance as a force to allocate capital to society’s highest and best uses.

This episode offers a candid look at how one of Canada’s largest university pension plans is leading with purpose, pragmatism, and long-term vision.

Take a listen here.

The DEI & ESG retreat isn’t just bad business, it’s cowardly. We define who we are in moments of fear, and it’s time to make a stand

by @ Rachel J. Robasciotti & Stacey Abrams, September 3, 2025

Adasina’s Founder & Co-CEO Rachel J. Robasciotti and Stacey Abrams, Founder of American Pride Rises Network, cut through the polarized rhetoric on diversity, equity, and inclusion (DEI) programs and ESG [integration] to deliver a salient, evidence-based message: DEI and ESG [integration] are prudent business tactics and investment essentials.

Read the full op-ed published in Fortune here.

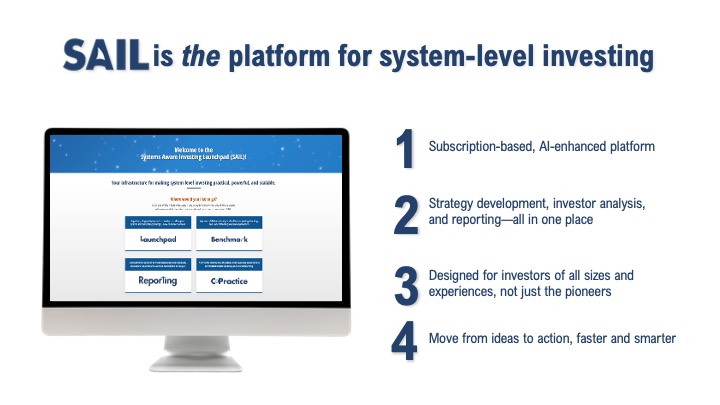

Special Rate for the first 30 SAIL 2.0 Subscribers!

TIIP’s next-generation, AI-enhanced platform helps institutional investors turn system-level investing from theory into practice.

Climate instability, inequality, and market short-termism are no longer abstract—they’re material. SAIL 2.0 gives you the tools to act.

✅ Strategic tools without starting from scratch

⏱️ Benchmarking in hours, not weeks

📊 Reporting that adds value—not workload

🤝 A peer community tackling systemic risks together

The first 30 subscribers receive a special launch rate. Don’t miss your chance to move from reactive reporting to proactive regeneration.

👉 Email us at [email protected] to schedule a demo or find out how to subscribe today!

TIIP and Friends around Town!

Where we’ve been

September 21: Wiliam joined Monique and the team at Make Justice Normal to kick off NY Climate Week with Street Works Earth, their annual arts + climate festival in Jackson Heights, Queens. This year’s event added a career fair, Future @ Work, where Faiza Azam, Daniel Barker, Margot Brown, Rachel Castillo, Dalila Mujagic, Neha Savant, Aseante Renee, Donita Volkwijn, Ayesha Williams, and others shared their career journey.

September 22: Monique facilitated a break-out session at the “Climate Change & Fiduciary Duty: System Stewardship in Theory and Practice” gathering organized by the Sierra Club Foundation.

September 22: Curated by Kristy Drutman, Monique joined Daniel Carillo of Anthesis, Jessica Ajoku of Capricorn and Breene Murphy of Carbon Collective for the Climate Finance & Business Jobs session at the Green Jobs Pavilion 2025.

October 9-10: William joined Alex Woods of British International Investment, Tarik Perkins of Start Out, and Carla Sutherland of Justice Work for a conversation entitled “Lessons Learnt from Past LGBTIQ+ Efforts” at the Global LGBTIQ+ Inclusive Finance Forum, hosted by Koppa-The LGBTI+ Economic Empowerment Lab.

October 16: William delivered the keynote address “A Call for Collective Action” at the Impact Summit America: Impact Investing Conference for Institutional Investors & Asset Owners.

October 21: At the ICCR 2025 Fall Conference, Monique moderated a conversation between panelists Daryn Dodson of Illumen Capital, Chavon Sutton of Cambridge Associates, Lynne Hooey of Kataly Foundation and Rev. Sidney Williams of Crossing Capital entitled “System-Level Investing and the Future of Shareholder Advocacy,” which was curated by the Racial Justice Investing Coalition (RJI) and followed powerful opening remarks by Courtney Wicks of Movement Finance and RJI, and featured a closing appeal offered by Anandi Somasundaram of RJI.

October 21: At the ICCR 2025 Fall Conference, Monique moderated a conversation between panelists Daryn Dodson of Illumen Capital, Chavon Sutton of Cambridge Associates, Lynne Hooey of Kataly Foundation and Rev. Sidney Williams of Crossing Capital entitled “System-Level Investing and the Future of Shareholder Advocacy,” which was curated by the Racial Justice Investing Coalition (RJI) and followed powerful opening remarks by Courtney Wicks of Movement Finance and RJI, and featured a closing appeal offered by Anandi Somasundaram of RJI.

October 27-28: William attended the IEN Annual Forum where 100+ endowment, foundation, and sustainable investing industry leaders gathered and explored topics such as: Sustainable & System-Level Investing, Fiduciary Duty, Responsible Tech and AI, Climate Risk & Opportunity, Democracy & Political Risk, Inequality as Investment Risk.

Where we’re heading

November 12: William will head to Zeist to join PGGM alongside the Sustainable Pension Investments Lab (SPIL) and the Principles for Responsible Investment (PRI) for a gathering of pension and insurance fund leaders focused on system-level investing.

November 18: Monique will join Eric Krull of Northern Trust and Amar Nigam of Koppa for “Beyond Impact: Applying a System-level Lens to Investing” organized by Out In Finance. Register here.

November 19: Across the country, more public funds are embracing a total portfolio approach—breaking down silos to understand how every decision, from manager selection to climate risk, connects to the bigger picture. William will be joined by Lynn Paquin, Portfolio Manager at CalSTRS, to provide a joint keynote on system-level investing at Pension&Investment’s Public Funds Conference in Austin, TX. They’ll explore why portfolio performance can’t exist in isolation—and how leading funds are redefining fiduciary duty through system-level thinking. See how CalSTRS is putting this approach into practice to build portfolios that are resilient, sustainable, and designed for generations to come. Don’t miss this forward-looking conversation on the future of portfolio management. Register here.

November 19: Across the country, more public funds are embracing a total portfolio approach—breaking down silos to understand how every decision, from manager selection to climate risk, connects to the bigger picture. William will be joined by Lynn Paquin, Portfolio Manager at CalSTRS, to provide a joint keynote on system-level investing at Pension&Investment’s Public Funds Conference in Austin, TX. They’ll explore why portfolio performance can’t exist in isolation—and how leading funds are redefining fiduciary duty through system-level thinking. See how CalSTRS is putting this approach into practice to build portfolios that are resilient, sustainable, and designed for generations to come. Don’t miss this forward-looking conversation on the future of portfolio management. Register here.

November 19: The Federal Reserve Bank of New York will host a hybrid event on fostering and improving markets channeling investments into under-resourced communities. Monique and William will represent the System-level Investing Design Team to share progress to date. Register here.

Follow us on LinkedIn to keep up with the latest TIIP news and find out how to join the system-level investing movement. Have questions about system-level investing? Email us at [email protected].