January Newsletter

Save the date! TIIP’s 5th Annual Symposium on System-level Investing “From Ambition to Action” will be held on April 14, 2026.

System-level risks are no longer abstract or peripheral to investment performance. Climate instability, inequality, democratic fragility, financial concentration, and geopolitical disruption now operate as interlocking forces that shape beta, constrain diversification, and determine long-term portfolio outcomes. Yet most investment institutions remain organized around tools, governance structures, and decision frameworks designed for asset-level optimization—not for managing risks that arise at the level of markets and systems.

The 5th Annual Symposium on System-Level Investing convenes asset owners, asset managers, fiduciaries, foundations, and field-builders to confront this implementation gap. Co-hosted by The Investment Integration Project (TIIP), the U.S. Impact Investing Alliance (USIIA), the Intentional Endowments Network (IEN), the Interfaith Center on Corporate Accountability (ICCR) and the Principles for Responsible Investment (PRI) and sponsored by the Center for Monitored and Ethical Investment and Domini Impact Investments, the Symposium focuses squarely on what it takes to operate as a system-level investor in practice.

This year’s program is organized around a core insight reflected throughout the agenda: there is no single model of system-level investing. Instead, different institutions—pension funds, global asset managers, foundations, faith-based investors, and long-horizon asset owners—exercise influence through different leverage points. Through contrasting viewpoints, candid case studies, fiduciary analysis, and tool launches, the Symposium examines how engagement, governance reform, capital deployment, standard-setting, field-building, and internal guardrails each function as system-level tools when deployed with discipline and intent.

Across the day, participants will explore:

- how fiduciary duty is evolving as systemic risks become foreseeable and material;

- how total-portfolio dashboards and decision-support infrastructure can connect system health to portfolio management;

- how stewardship, collaboration, and escalation operate at scale;

- how flexible and philanthropic capital can help build or repair markets; and

- how investors shape system outcomes not only through capital allocation, but through norms, standards, and collective action.

The Symposium is intentionally designed as a working convening—for institutions grappling with the practical challenge of moving from episodic action to durable influence, and from aspiration to repeatable practice. The goal is not consensus around a single approach, but clarity about roles, responsibilities, and operating choices that define the next standard for long-term investing in a system-shaped world.

Click here to learn more and register your interest in attending in-person or by Zoom.

Want to explore sponsoring the 2026 symposium? Reach out to Monique Aiken at [email protected].

Featured Video from the 4th Annual Symposium: Global Perspective, Japan

This month’s featured video is the Fireside Chat between TIIP CEO, William Burckart and Takeshi Kimura, Special Adviser to the Board, Nippon Life Insurance, Board Director, PRI and inaugural recipient of the Catalyst Award for System-level Investing.

Articulated in its 2024 responsible investment report, Nippon Life holds the belief that investors should address system-level risks because such risks threaten all companies and can therefore deteriorate market returns on a global scale.

The conversation shared how Nippon Life views systemic risk as investment risk and that managing its investments in this way is essential to carrying out its responsibility to its policyholders and its identity as a “future maker” instead of a “future taker”.

#ICYMI

Last week, TIIP released the Nippon Life Insurance Company Case Study: System-Level Investing Through P-squared Investing

Last week, TIIP released the Nippon Life Insurance Company Case Study: System-Level Investing Through P-squared Investing

This comprehensive case study examines how Japan’s largest private asset owner (¥83,549 billion in assets) has pioneered a systems approach recognizing that People and Planet aren’t separate objectives—they’re interdependent. As Nippon Life explains: it’s People times Planet. Multiply by zero on either side, and the outcome is zero.

The results:

📈 ¥2.6 trillion in sustainability-themed investments

🌱 4.27 million tonnes GHG emissions reduced (2023-2024)

🌍 45.9% reduction in total portfolio emissions vs 2010

🤝 88% of top emitters disclosed reduction roadmaps

📊 Groundbreaking frameworks shared publicly to advance the field

But the numbers are just the start. The report reveals how Nippon Life:

- Established two strategic pillars—guardrails and standard-shaping—connected by norm-setting

- Developed the Transition Finance Framework to standardize 1.5°C pathway evaluation

- Published the Nature Finance Approach for measuring restoration impacts

- Leads field-building through PRI Board, NZAOA, GFANZ, TISFD membership

- Engages 78 top Scope 1&2 emitters and 43 top Scope 3 emitters systematically

- Uses policy engagement to shape system-level outcomes (G7 recommendations, FSA consultations)

- Operates as “future makers” rather than “future takers”

💡 This is more than an asset owner case study—it’s a practical example for institutional investors ready to address the fallacy of composition and recognize that what works at the firm level doesn’t automatically add up to system resilience.

Read the full report here.

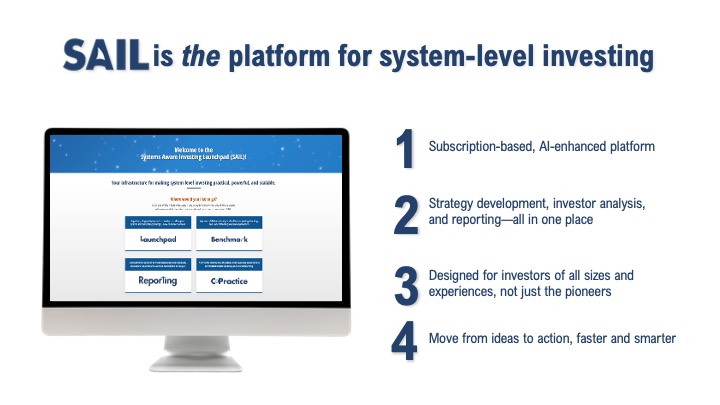

New Features Being Added to SAIL in 2026

TIIP’s next-generation, AI-enhanced platform helps institutional investors turn system-level investing from theory into practice.

TIIP’s next-generation, AI-enhanced platform helps institutional investors turn system-level investing from theory into practice.

Tell us your problem, SAIL just might be able to help.

- From capital needs assessments for place-based investors to bespoke playbooks to take systemic stewardship programs to the next level. SAIL can do in hours what would otherwise take months.

- Want a deep dive on a specific issue or intersection of risks to understand leverage points, capital requirements to mitigate the issue and understand the appropriate sequencing of actions to stabilize the risk or create long term value? Reach out, we can help!

🚀SAIL 2.0 brings the efficiencies of AI to systemic risk management, doing in hours what once took months: aligning strategy, benchmarking performance, structuring stewardship, and automating disclosure—through a systems lens.

What SAIL 2.0 does (at a glance) 👇

- Turns data chaos into systemic risk intelligence: upload once; SAIL standardizes and interprets data, flags gaps, and surfaces next actions.

- Benchmarks what matters: compare peers, managers, and asset owners side-by-side to spot alignment gaps and high-performing outliers.

- Automates disclosures: reuse existing content for PRI, TCFD, stewardship codes, and more—cutting duplication and time.

- Structures strategies and stewardship: translate system-level goals into portfolio-wide construction and escalation pathways.

- Built for scale: roadmap toward fully proactive, agentic AI guiding systemic risk action across the investment lifecycle.

But wait, there’s more!

- Build a systems-aware strategy without starting from scratch

- Diagnostics that highlight strengths, gaps, and next-best actions in one click

- Peer/manager benchmarking that actually informs decisions

- Bring interoperability to mandatory or voluntary reporting to reduce survey fatigue and compliance burden

Why this is different

No other platform integrates diagnostics, systemic frameworks, automated reporting, and benchmarking in one place—and does it with agentic AI purpose-built for institutional investors.

SAIL is not another dashboard; it is the intelligence and infrastructure layer the field needs for managing systemic risks, rooted in fiduciary duty.

👉 Click the button below to schedule a demo to hear more about what new features we are rolling out in 2026 or find out how to subscribe today!

Have questions about system-level investing? Email us at [email protected].