4th Annual Symposium on System-level Investing Tuesday, April 8, 2025

We have a date! TIIP’s 4th Annual Symposium on System-level Investing, and 10-year anniversary celebration of TIIP, will be held on April 8, 2025.

Want to sponsor next year’s symposium? Reach out to Monique Aiken at [email protected] to explore.

Click the here to add your name to the notification list to be the first in line to receive further details, as they crystallize.

New resources from UN PRI on system-level investing

In a new piece for ImpactAlpha on “Charting the path forward for responsible and impact investing with a systems lens,” William Burckart, the CEO of TIIP, shares a few reflections from his experience at this year’s annual PRI in Person conference in Toronto, hosted by the UN-backed Principles for Responsible Investment.

From the article:

“The path forward for responsible, sustainable, and impact investing may be as complex as the challenges we face. Among investors at this year’s PRI in Person conference in Toronto, there was a growing recognition that system-level solutions offer our best chance at addressing interconnected crises such as climate and inequality….” Read more.

The UN PRI has been helping to foster the system-level investing ecosystem since its Sustainable Financial System (SFS) program launched in 2016. The resources included below capture a number of the efforts it has made on this front over the years. Looking to engage further? Consider applying to the PRI System Stewardship Advisory Committee. Learn more.

In a blog post, “What is system-level investing,” UN PRI’s Nithya Iyer shared a cogent explainer of the approach alongside key resources for those seeking to explore the concept further. The post announced plans for continued support for knowledge-building and programs related to system-level investing in 2025.

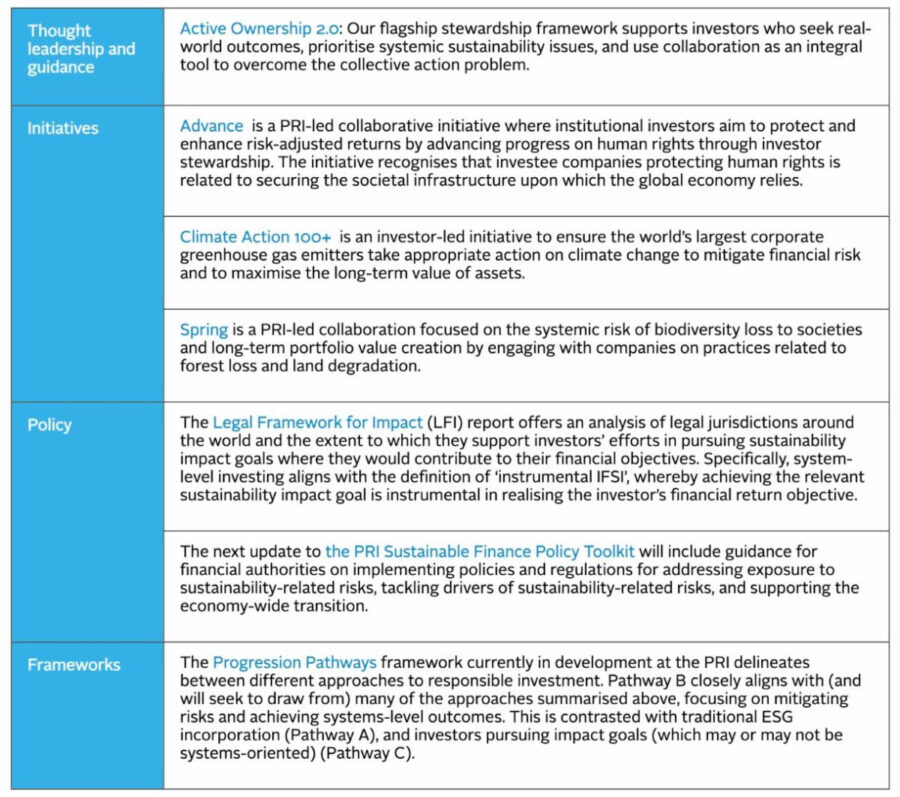

The table below lists the current programs advancing the development of system-level investing at the PRI:

TIIP’s SAIL platform was cited as a tool that investors could use to support the integration of system-level thinking in their practice. As the article explains, “The Investment Integration Project’s System Aware Investing Launchpad provides investors with tools to implement a system-level approach in areas such as asset allocation and manager selection.”

In addition, the TIIP team authored three of the ten publications listed, including:

- Burckart, William and Lydenberg, Steve, Berrett-Koehler Publishers (April 13, 2021), 21st Century Investing: Redirecting Financial Strategies to Drive Systems Change

- Burkart, William, Eng, Melissa and Suki, Lenora, The Investment Integration Project (2023), (Re)Calibrating Feedback Loops: Guidance for Asset Owners and Institutional Investors Assessing the Influence of System-level Investing

- Lydenberg, Steve, The Investment Integration Project (2015), Portfolios and Systemic Framework Integration: Towards a Theory and Practice

The full text of the post can be found here.

On October 16th, Nathan Fabian, Chief Sustainable Systems Officer at PRI and Takeshi Kimura, Board Director at PRI and Special Adviser to the Board, Nippon Life Insurance, published a piece entitled, “Why system-level thinking is required of responsible investors in an inflationary environment.”

The whole article is worth a close read for how it articulates the link between inflation, climate change and income inequality. It also suggests how institutional investor actions can help to mitigate these systemic risks. Spoiler alert: its system-level thinking. Excerpt below:

The full text of the post can be found here.

SAIL Updates

The annual SAIL update is underway! We’re refreshing the content in the “issue agnostic” and income inequality tools and resources, and adding new ones related to climate change, racial inequity and LGBTQIA+ inequity.

Subscription rates will increase once the new content is in, so subscribe now at our summer promotional rate while you still can! Email us at [email protected] to learn more.

Ask us how to still subscribe at our pre-update promotional rate!

Want access to the just to CoPractice (which will always remain free) or receive a live demonstration? Contact TIIP at [email protected].

TIIP + Friends About Town

- Monique was honored to be selected as the featured member in the September newsletter of WISE network, Women Investing in the Sustainable Economy. On October 10th, Monique also spoke at a WISE member webinar on the topic of mentorship.

- On October 8th, At PRI in Person in Toronto, Bill shared the TIIP perspective on a panel entitled “Addressing systemic risks through stewardship” as well as a side event dedicated to supporting a community of practice of system-level investors. He shared reflections on the event on this op-ed on ImpactAlpa, “Charting the path forward for responsible and impact investing with a systems lens.“

- At the GIIN conference on October 24th, William spoke on the panel entitled “Impact Measurement and Management for Diversity, Equity & Inclusion.” The other panelists included: Hetal Sheth Damani, Impact Partner at Trill Impact, Brianna Losoya-Evora, Head of Impact Measurement and Management at Sweef Capital and Melissa Bradley, Managing Partner at 1863 Ventures.

- Also on October 24th, Tiffany Reeves of Faegre Drinker, one of TIIP’s favorite fiduciary duty experts guests lectured at Willam and Jon Lukomnik’s Sustainable Finance class at Columbia to discuss how law and regulation can set a positive or negative context for sustainable investment and system-level investment, including examples by jurisdiction.

- October 24th was a busy day as Monique moderated a virtual session at the Philanthropy Advisors of Color Convening 2024, hosted by Unboxed Philanthropy. The session, “Impact Investing & Venture Philanthropy”, featured Erika Seth Davies, CEO of Rhia Ventures and the REAL, Natalia Oberti Noguera, Founder and CEO of Pipeline Angels, and Austin Serio, Co-founder or ShockTalk.

Up next:

TIIP was one of twelve design teams that were invited to join forces with the Federal Reserve Bank of New York to advance the Making Missing Markets initiative.

Want to learn more? On Thursday, November 14, 2024, the Federal Reserve Bank of New York will host an in-person event focused on creating and improving markets to deliver investments to under-resourced communities. The event will focus on examples of effective channels for investing in the health, climate resilience, and household financial well-being of communities. Speakers will highlight strategies that connect new sources of capital to community needs; scale existing sources of capital for communities; and connect previously unlinked buyers and sellers.

This event will be of interest to leaders in finance, philanthropy, community development, and academia. In-person registration closes on Monday, November 12, 2024. Register here.

Have questions about system-level investing? Email us at [email protected].