TIIP Beyond 10: From Insight to Implementation

Founded in 2015, The Investment Integration Project (TIIP) set out with a bold vision: to help investors align their strategies and practices with the complex realities of the 21st century. From climate change to financial market volatility to health and social equity, we sought to demonstrate that these issues are interconnected—and that investors not only have a stake in systemic well-being, but a powerful role to play in safeguarding it.

Over the past decade, TIIP has worked to advance system-level investing: an approach that encourages investors to consider the broader social, environmental, and financial systems their portfolios rely on. With the right guidance, tools, and diagnostics, investors can help strengthen those systems—enhancing long-term financial performance and driving lasting market transformation in the process.

As we enter our second decade, TIIP remains committed to helping investors transition from fragmented impact investment, stewardship, and ESG integration practices to coherent, system-level strategies. Whether you’re just getting started or looking to lead, TIIP can support your journey.

Over the coming months, we’ll be building on our applied research and thought leadership, including our report on System-level Investing: Case Studies of Investors Leading the Way. In the meantime, we’re adding to the AI-enhanced capabilities of our SaaS platform (SAIL) every day. See below for more details on what we’ve added just in the past month.

Thanks for being part of this growing community. Let’s keep building smarter systems together.

✨ Introducing New Features in SAIL: The System-level Investing Platform

TIIP is excited to announce a new wave of features and data within SAIL, our subscription-based, AI-enhanced platform for investors.

SAIL helps investors develop system-level strategies, evaluate alignment, streamline reporting, and connect with peers across the investment ecosystem.

🚢 Ready to Set SAIL?

Join the movement to move from reactive reporting… to proactive regeneration. The first 30 subscribers to SAIL 2.0 will receive a promotional rate. Don’t wait!

To schedule a demo, or subscribe, email us today!

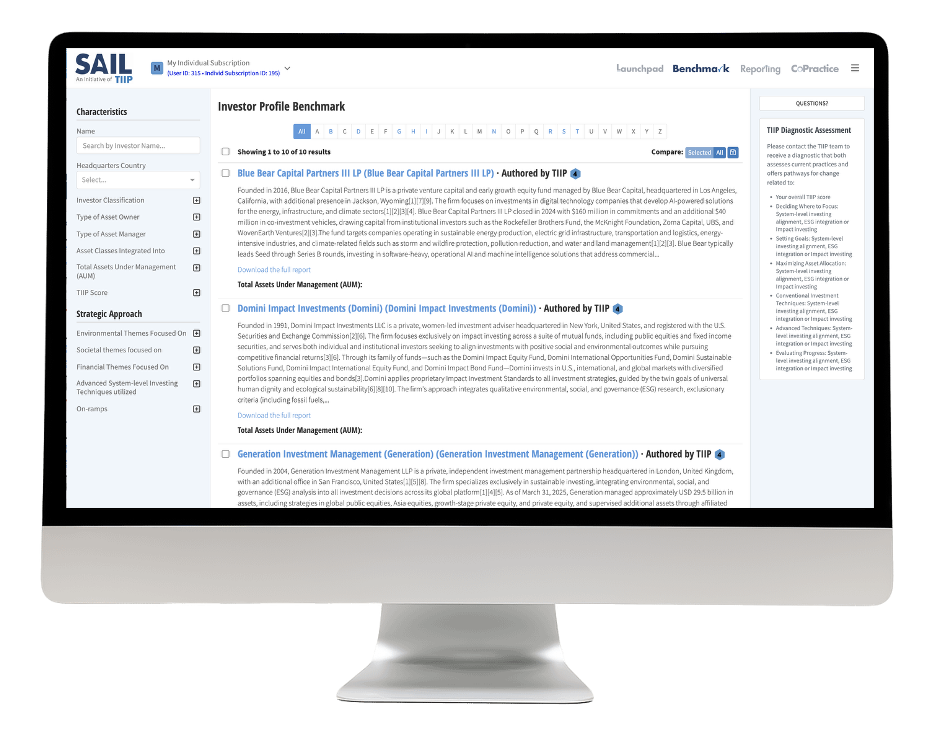

Benchmark: Peer Insights, Strategic Learning

Our growing Benchmark database offers in-depth investor profiles, strategic assessments, and emerging best practices from leaders across the globe.

Our growing Benchmark database offers in-depth investor profiles, strategic assessments, and emerging best practices from leaders across the globe.

We’ve profiled over 30 asset owners, managers, consultants, and multi-stakeholder initiatives committed to advancing system-level investing (and revealed where some are falling short).

Notable entries (with more added every day) include:

- Asset Owners:

- Builders Vision, Guy’s & St. Thomas’ Foundation, HESTA, People’s Pension, University Pension Plan Ontario, Australian Ethical, OTPP, HOOPP, GPIF, OMERS

- Asset Managers:

- BlackRock, Ninety One, State Street, Invesco, Fidelity International, Federated Hermes, Northern Trust, Amundi

- Multi-stakeholder Initiatives:

- The TWIST (Together We Invest for Systems Transformation) initiative, Toniic, Tipping Point Fund on Impact Investing, Making Missing Markets Initiative

This growing database serves as a gateway to system-level investing, enabling users to benchmark practices, connect with like-minded peers, explore new models for influence and accountability, and determine where their engagement—whether through capital, voice, or leadership—can be most effectively deployed across multi-stakeholder initiatives.

👉 Learn more about Benchmark here.

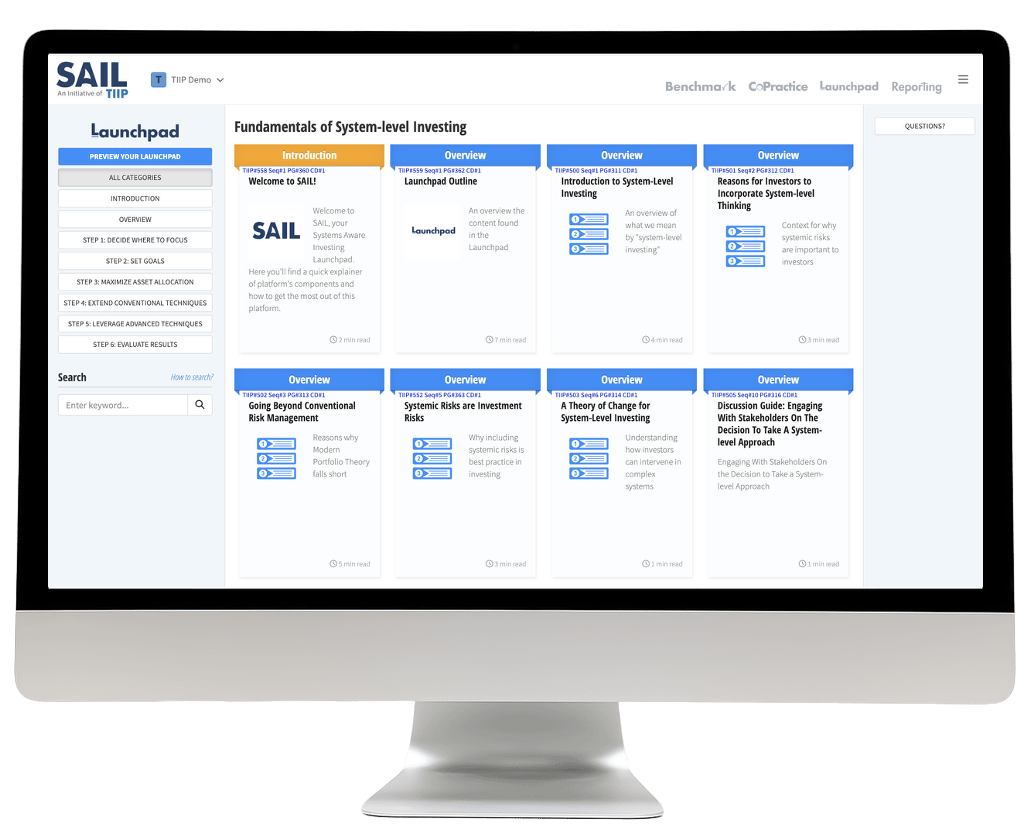

Launchpad: Diagnostic Tools for Institutional Investors

TIIP’s Launchpad assessments are designed to help institutional investors evaluate and evolve their approach to system-level investing, as well as on-ramps activities like impact investing, stewardship, ESG integration, and the like.

Each diagnostic maps current practices and highlights opportunities for progress across key focus areas:

- Strategic Focus – Clarify system-level, ESG, impact, and stewardship priorities

- Goal Setting – Align investment goals with long-term systemic outcomes

- Asset Allocation – Increase influence through capital deployment and a total portfolio approach

- Implementation – Leverage investment tools, stewardship, and engagement

- Evaluation – Track impact and influence on systemic issues over time

Interested in a diagnostic for your organization?

📧 Reach out at [email protected]

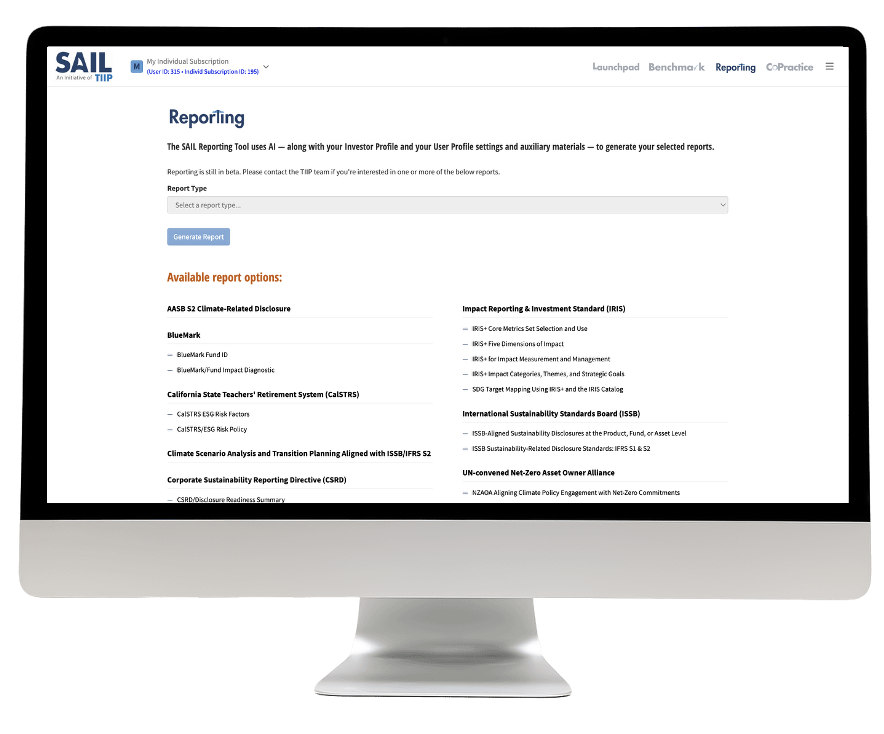

Reporting: Simplified, Streamlined, System-Aligned

SAIL’s Reporting tools enable investors to meet both mandatory and voluntary reporting requirements—without duplication or fatigue.

With built-in interoperability and AI assistance, users can:

-

-

-

-

-

-

-

-

-

- Auto-populate key frameworks like PRI, GRESB, ISSB, CSRD, SFDR, IRIS+, and more

- Upload supporting documents and generate custom reports

- Track disclosures and align with system-level goals in real time

-

-

-

-

-

-

-

-

Recently supported frameworks include:

- Climate & Transition Planning – ISSB/IFRS S2

- Corporate Reporting – CSRD, GRI

- Stewardship & Governance – UK Stewardship Code, Net-Zero Asset Owner Alliance (NZAOA)

- ESG & Impact – GRESB (all modules), IRIS+, GIIN Impact Principles, SFDR

- Systems Thinking & Impact Strategy – Rockefeller Philanthropy Advisors (RPA) series

- Endowment & Foundation-Specific – IEN Endowment Benchmark

This feature is continually evolving to help investors report smarter, faster, and more strategically.

📧 Reach out at [email protected]

Follow us on LinkedIn to keep up with the latest TIIP news and find out how to join the system-level investing movement. Have questions about system-level investing? Email us at [email protected].